Brilliant Earth Lowers Guidance Following Q2 Sales Dip

The jewelry retailer is forecasting sales will fall as much as 14 percent in its third quarter.

For the second quarter ending June 30, the jewelry retailer posted net sales of $105.4 million, down 4 percent from $110.2 million in Q2 2023.

In the first half of the year, the company reported net sales of $202.8 million, down 3 percent from $207.9 million.

“I’m pleased with our ability to manage the business with agility and discipline in the face of a challenging industry and macroeconomic backdrop,” said Brilliant Earth CEO Beth Gerstein in a statement.

“We delivered quality order growth, expanded gross margin, and exceeded our profitability expectations.”

Adjusted EBITDA was $5.5 million, down 29 percent year-over-year, but exceeding the retailer’s expectations.

The results were in line with the company’s forecast of a low to mid-single-digit decline in net sales and a low single-digit percentage adjusted EBITDA margin.

For the first half, adjusted EBITDA was $10.6 million, or 5 percent of net sales, compared with $13.3 million, or 6 percent of net sales, in the prior-year period.

Net income was $1.4 million compared with $1.2 million in the prior-year period.

“While the overall industry remains challenged, particularly in bridal and e-commerce, we still maintain our expectations around a multi-year path to normalization,” Gerstein said on an earnings call held Thursday evening.

She said the industry’s “highly promotional” environment has continued, noting “elevated discounting activity” among peers, a trend that persisted in Q2 and has continued into Q3.

“We remain focused on investing in quality growth and protecting our premium brand to deliver sustainable profitability and position us to take share in this highly fragmented industry,” she said.

In the second quarter, gross profit was $64.1 million, or a 61 percent gross profit margin, compared with $63.5 million, or a 58 percent gross profit margin, in the prior-year period.

In the first half, gross profit was $122.4 million, or 60 percent of sales, up 4 percent from $117.2 million, or 56 percent of sales, in the prior-year period.

The total number of orders in the second quarter rose 4 percent while the average order value (AOV) fell 8 percent to $2,374.

Repeat orders were up 17 percent year-over-year in the second quarter.

For the first half, the total number of orders rose 8 percent while the AOV fell 10 percent to $2,387.

The company has noted in previous quarters that non-bridal jewelry sales are on the rise, but the category has a lower average price point, which is bringing down its AOV.

Fine jewelry bookings in its stores increased by 29 percent year-over-year in the second quarter.

“Fine jewelry offers us an incredible opportunity to acquire lifelong customers outside of our core bridal business, and to expand our reach among both first time and repeat purchasers,” said Gerstein.

The quarter included two important gifting holidays, said Gerstein, which were Mother’s Day and Father’s Day.

Excluding holiday shopping in last year’s Q4, the company said it had its biggest ever day of fine jewelry sales in the lead-up to Mother’s Day.

Bridal jewelry sales did not fare as well.

“In Q2, what we saw was that bridal was down in the low double digits, and we have seen that slightly worsen since then,” said Gerstein.

She noted there have been some positive indicators, including bookings growth of 6 percent to view engagement ring designs in its “Signature” collection.

Bookings for wedding and anniversary bands saw double-digit growth, with men’s bands seeing 32 percent year-over-year growth.

The company recently launched its Brilliant Earth Fairmined Bridal Collection, which uses Fairmined Gold to support small-scale mining communities.

Gerstein noted that customers are taking longer to make decisions on highly considered purchases in light of economic headwinds.

As bridal sales struggle, Gerstein highlighted the retailer’s diversified approach, like bolstering its fine jewelry offerings to reach new customers.

Though it started as an online-only business, Brilliant Earth has been expanding its brick-and-mortar network in recent years.

It is on track to open three new showrooms in the second half of the year, including two in Boston, at the Seaport and in Chester Hill, and its first street-level location in New York City’s Nolita neighborhood.

Looking to the year ahead, the company lowered its fiscal guidance.

For fiscal 2024, Brilliant Earth is now forecasting net sales of $410 million to $425 million, down from its prior guidance of $455 million to $469 million.

Adjusted EBITDA is expected to be $12 million to $16 million, down from its prior guidance of $14 million to $22 million.

For the third quarter, the company is expecting net sales to fall 11 to 14 percent year-over-year while adjusted EBITDA will either break even or have a low single-digit percentage adjusted EBITDA margin.

Chief Financial Officer Jeff Kuo said its Q4 performance is expected to be stronger than Q3 from a top-line perspective.

“Key drivers of Q4 performance will include realizing uplift from showrooms, the continued strong performance of fine jewelry, the fact that Q4 is the biggest quarter for fine jewelry sales, and our ongoing brand building efforts, including during the holidays,” said Kuo.

Gerstein said, “Since June, we’ve encountered a weaker-than-expected consumer environment, specifically for highly considered purchases, and we remain cautious for the rest of this year, given the recent headlines and economic uncertainty.”

“We recognize that this is a challenging period, and we are not immune to its impact,” she said, adding the company will continue to lean on the strength of its brand.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The giant gem came from Karowe, the same mine that yielded the 1,109-carat Lesedi La Rona and the 1,758-carat Sewelô diamond.

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

Supplier Spotlight Sponsored by GIA

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

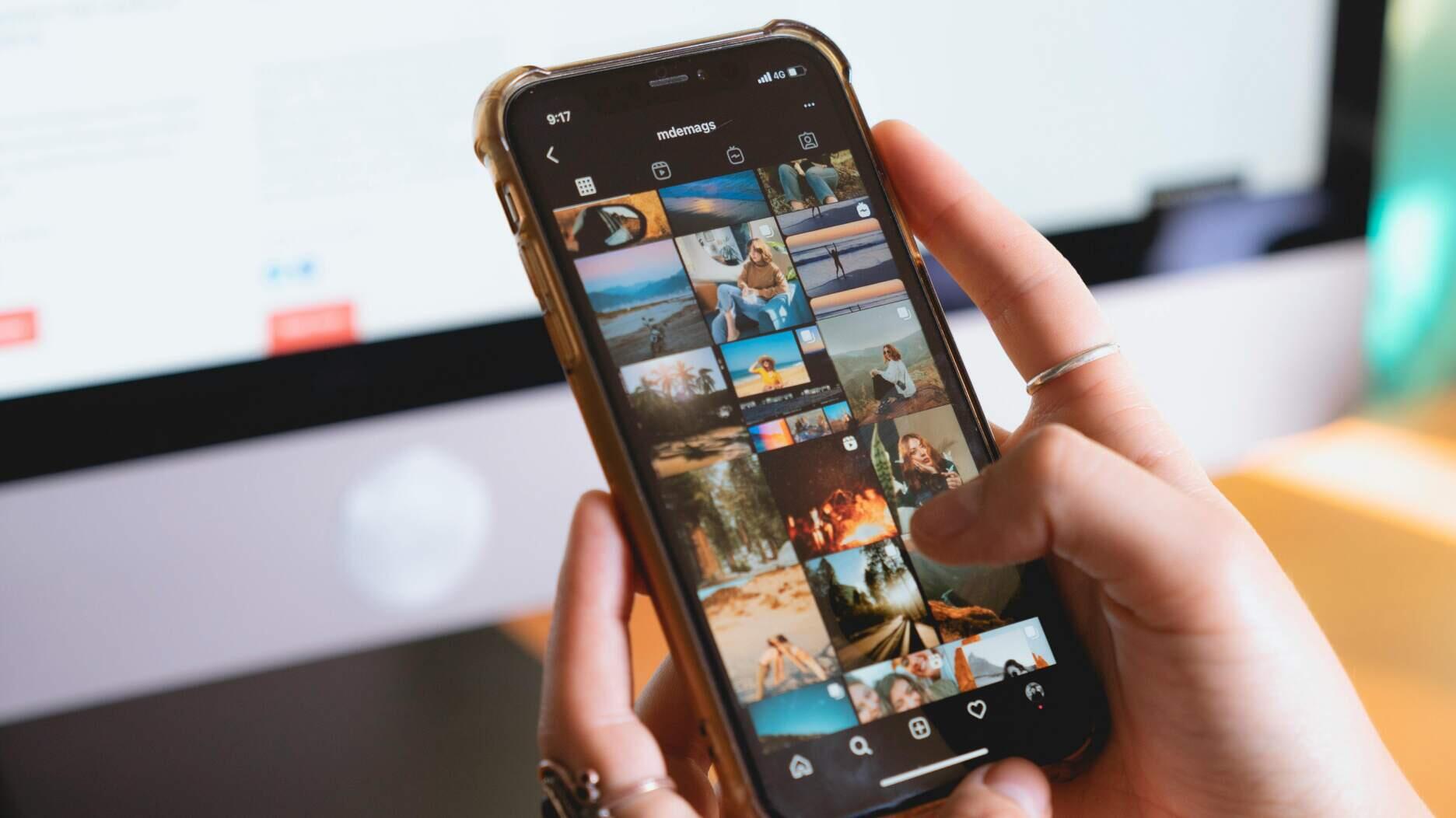

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

The gemstone company is moving to the Ross Metal Exchange in New York City’s Diamond District.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.