Pandora Raises Guidance Again as Q2 Sales Climb Double Digits

The jewelry retailer is eyeing expansion, increasing the number of stores it plans to open this year.

The company reported Monday that second-quarter revenue was up 15 percent year-over-year at actual exchange rates to 6.77 billion Danish kroner ($990 million), with like-for-like sales growth of 8 percent.

First-half revenue totaled 13.61 billion Danish kroner ($1.99 billion), up 16 percent at actual exchange rates, with like-for-like sales growth of 9 percent.

“Our strategy continues to take Pandora to new heights despite general consumer spending being somewhat sluggish,” said Pandora CEO Alexander Lacik.

“We have successfully started the journey to make Pandora known as a full jewelry brand, and our results show that consumers like what they see.”

Pandora credits its success to the strength of its brand, bolstered in part by its “Be Love” campaign, which aims to reframe consumer perception of the company as a complete jewelry brand, rather than a company that just sells beads and charms.

While the campaign is less than a year old, Pandora said it’s already seen an increase in traffic in its stores and on its website as a result.

The company reported higher traffic across channels in the second quarter, with online sales seeing 19 percent like-for-like growth and accounting for 20 percent of total revenue.

Pandora-owned stores are outperforming partner stores, it said, posting 6 percent like-for-like growth while sales at franchise stores were flat.

In the United States, Pandora reported 9 percent like-for-like growth.

“The overall jewelry market sequentially slowed in the second quarter, and the growth in Pandora U.S. continues to be well ahead of the broader market, which remains flattish to slightly down,” said the company.

Its key European markets also performed well, with 10 percent like-for-like growth in the region and Germany once again the standout.

Second-quarter sales grew 13 percent in the rest of Pandora’s markets.

Like-for-like sales were up 1 percent for its core segment, which includes its “Moments” and “Me” collections and its collaborations.

Sales in the segment were weighed down by the “Collabs” segment, which was up against tough comparables after the success of last year’s “Disney 100” collection.

Pandora’s “fuel with more” segment, which includes its lab-grown diamond jewelry as well as its “Timeless” and “Signature” collections, saw sales grow 29 percent in the quarter.

Sales of its lab-grown diamond jewelry collection totaled 61 million Danish kroner ($8.9 million) in the quarter.

The collection posted like-for-like growth of 88 percent, though lab-grown diamond jewelry sales still represent less than 1 percent of Pandora’s total sales.

Pandora launched the “Pandora Essence” collection globally in Q2 and said the initial feedback has been encouraging.

The collection aims to bring a contemporary and sculptural feel to jewelry staples, and Pandora said it will continue to explore new design aesthetics.

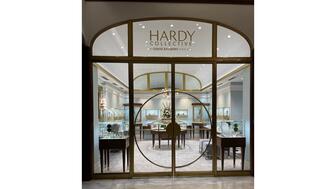

The company also expanded its store network in Q2, opening a net 143 concept stores and 112 Pandora-owned shop-in-shops over the past 12 months.

Pandora upped the number of stores it plans to open this year to 100 to 150 concept stores from its prior guidance of 75 to 125.

It also now plans to open 50 to 75 shop-in-shops, more than its previously stated goal of 25 to 50.

The company is forecasting 400 to 500 targeted net openings from 2024 to 2026.

Pandora also opened its first global two-story flagship store in its hometown of Copenhagen, marking its largest store to date at 500 square meters (nearly 5,400 square feet).

The jewelry retailer operates 6,635 points of sale as of Q2, a gain of 108 year-over-year.

Looking to the year ahead, Pandora has once again raised its fiscal guidance.

Pandora now expects to see organic growth of 9 to 12 percent, up from its prior guidance of 8 to 10 percent. Its EBIT margin guidance is unchanged at around 25 percent.

So far in Q3, Pandora said sales are “healthy,” with like-for-like growth in the mid-single digits.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The giant gem came from Karowe, the same mine that yielded the 1,109-carat Lesedi La Rona and the 1,758-carat Sewelô diamond.

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

Supplier Spotlight Sponsored by GIA

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

The gemstone company is moving to the Ross Metal Exchange in New York City’s Diamond District.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.