Signet Awaits Engagement Recovery as Q1 Sales Sink 9%

The company is expecting to see a 5 to 10 percent increase in engagements this year.

The jewelry giant, which is the parent company of several large jewelry store chains including Zales, Jared, and Kay Jewelers, also reaffirmed its recent guidance boost.

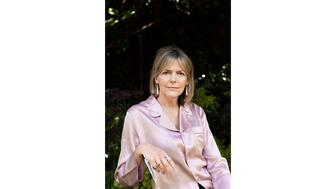

"Our results reflect notable acceleration from a sluggish February to the top half of expectations, with an even stronger May," Signet Jewelers CEO Virginia C. Drosos said in a company press release.

The May momentum showed up just in time for Mother’s Day sales.

Drosos noted a 4 percent increase in engagement ring sales in North America in the quarter, not including sales at its digital banners, James Allen and Blue Nile.

The company is still working to resolve the integration issues at its digital banners, which have led to fulfillment issues.

Drosos added, “Further, customers continue to respond well to our new product offerings and loyalty program, reflected in a meaningful improvement in comparable sales for fashion since February.”

Signet’s services category was once again a highlight, said Drosos, outperforming its merchandise in the quarter.

“We expect continued momentum in the second quarter, leading to a positive same-store sales inflection in the second half of fiscal 2025."

For the quarter ending May 4, Signet’s overall sales totaled $1.5 billion, down 9 percent year-over-year (10 percent on a constant currency basis.)

Same-store sales fell 9 percent.

In North America, Signet’s banners include Zales and Kay Jewelers, as well as Peoples in Canada.

Signet’s first-quarter sales in the region totaled $1.4 billion, down 9 percent year-over-year, due to a 2 percent decrease in total average transaction value (ATV) on a lower number of transactions.

Same-store sales were down 9 percent.

Signet’s international banners include Ernest Jones and H. Samuels.

International sales totaled $77.2 million, down 17 percent year-over-year (20 percent on a constant currency basis) due to a 15 percent drop in ATV and a lower number of transactions.

International same-store sales were down 3 percent in the quarter.

The ATV drop is in part related to the sale of 15 watch locations to Watches of Switzerland.

The company is looking to improve its U.K. business, closing 23 stores overall in the quarter, mainly Ernest Jones locations.

Signet is looking to close 20 to 30 stores and renovate 300 existing locations this year, said Chief Financial Officer Joan Hilson on an earnings call Thursday morning.

On the call, Drosos also spoke about the role of lab-grown diamonds in the company, which it refers to as lab-created diamonds.

“Over the past five years, LCD production has grown more efficient and has allowed LCD cost in retail to come down, providing attractive options for many price-conscious customers that are looking for larger carat options than they can afford in a natural diamond engagement ring,” she said.

“Our merchandise strategy and trade-up selling have been effective at largely maintaining our ATV while many engagement ring consumers looking to maintain a long-term value continue to be attracted to natural diamonds for their rarity and uniqueness.”

She noted the popularity of LGDs in fashion and the room for expansion in that category.

An increased number of lab-grown diamond fashion jewelry options led to a 14 percent increase year-over-year in lab-grown diamond fashion revenue in Q1, she said.

In an effort to bolster natural diamonds, Signet recently announced a partnership with De Beers Group.

The two are working together on a strategy to promote natural diamonds ahead of the expected uptick in engagements in the coming years.

Signet’s data shows engagements typically occur within three years of a couple dating, so recovery was said to begin later in fiscal 2024 and rebound in fiscal 2025.

Hilson said the company expects to see engagements up 5 to 10 percent this year.

Citing its own research, Signet said it expects to see a 25 percent increase in engagements, particularly for zillennial (the name given to those individuals born on the cusp of the millennial and Gen Z generations) couples, over the next three years as the effects of pandemic lockdowns fade.

Looking to the year ahead, Signet reaffirmed its guidance, expecting fiscal 2025 sales of $6.66 billion to $7 billion, with same-store sales ranging from down 5 percent to up 1 percent.

The guidance was updated April 3 following a preferred shares repurchase transaction, which increased its non-GAAP diluted earnings per share outlook to a range of $9.90 to $11.52 per diluted share from its previous range of $9.08 to $10.48 per diluted share.

In the second quarter, the company expects sales between $1.46 billion to $1.52 billion, with same-store sales down between 2 and 6 percent.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The giant gem came from Karowe, the same mine that yielded the 1,109-carat Lesedi La Rona and the 1,758-carat Sewelô diamond.

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

Supplier Spotlight Sponsored by GIA

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

The gemstone company is moving to the Ross Metal Exchange in New York City’s Diamond District.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.