Watches of Switzerland’s Fiscal-Year Sales Flat

Looking ahead, the retailer said it sees “enormous potential” in Roberto Coin’s ability to boost its branded jewelry business.

“We finished the year strongly, with Q4 sales in line with guidance and ahead of consensus,” CEO Brian Duffy said.

“We are confident that our strategy, exceptional client service and strong brand relationships enables us to continue to drive growth and gain market share.”

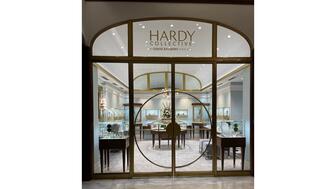

The company recently announced its $130 million acquisition of the North American arm of Roberto Coin, making it the brand’s exclusive distributor in the United States, Canada, Central America, and the Caribbean.

“Our acquisition of Roberto Coin Inc. dramatically accelerates our luxury branded jewelry strategy, and we see enormous potential in bringing together this iconic brand with our retailing expertise,” said Duffy.

For the fourth quarter ended April 28, Watches of Switzerland posted £380 million ($481.5 million) in total revenue, up 3 percent year-over-year (4 percent at constant currency rates).

In the U.S., revenue climbed 10 percent in Q4 (14 percent at constant currency rates), totaling £190 million ($240.7 million).

For the fiscal year, revenue totaled £1.54 billion ($1.95 billion), flat year-over-year (up 2 percent at constant currency rates).

Full-year revenue in the U.S. was up 6 percent (11 percent at constant currency rates) to £692 million ($876.8 million).

Revenue from sales of luxury watches rose 3 percent in the fourth quarter (5 percent at constant currency rates), buoyed by a strong performance in the U.S.

Full-year watch revenue ticked up 1 percent (3 percent at constant currency rates), with demand outweighing supply for key brands.

Its Rolex Certified Pre-Owned (CPO) watches performed better than expected in Q4, said the company. It plans to roll out the Rolex CPO program to more locations in fiscal 2025 as U.K. supply conditions improve.

Revenue from sales of pre-owned and vintage watches, including sales of pre-owned Rolexes through this program, doubled year-over-year in the fourth quarter.

Jewelry sales were flat in the quarter (up 1 percent at constant currency rates), marking an improvement from Q3 when jewelry sales sank 18 percent year-over-year (16 percent at constant currency rates).

For the full year, jewelry revenue was down 14 percent (13 percent at constant currency rates), with Q4 posting the best performance for the segment.

Branded jewelry significantly outperformed in the category in the quarter and for the full year, Watches of Switzerland noted.

The company has added new brands to its jewelry offerings, including Pomellato, Fred, Pasquale Bruni, and Fabergé.

Watches of Switzerland also has continued to develop its store network, opening a new Watches of Switzerland location at One Vanderbilt in New York City in March.

The company has several projects in the works for fiscal 2025.

A new Rolex boutique is set to open in Atlanta, replacing an existing multi-brand Mayors store.

Mayors’ Tampa, St. Johns, and Sarasota, Florida, stores will be relocated or expanded.

A new Watches of Switzerland store is planned for Pittsburgh, while the location in Plano, Texas, will be relocated, adding a Rolex boutique.

The Betteridge store in Greenwich, Connecticut, will be expanded to include an enhanced Patek Philippe space, while the location in Vail, Colorado, also will undergo an expansion.

In the U.K., the company is expanding its Patek Philippe space in a Watches of Switzerland London location and opening TAG Heuer and Tudor boutiques in Gatwick Airport, as well as other projects.

As of April 28, Watches of Switzerland had 223 stores across the U.K., U.S., and Europe, including 99 mono-brand boutiques with Rolex, Omega, TAG Heuer, Breitling, Tudor, Audemars Piguet, Grand Seiko, Hublot, Bulgari, and Fope, as well as its e-commerce presence and locations in Heathrow Airport.

Watches of Switzerland said it’s looking to the fiscal year ahead with cautious optimism given the “more challenging trading conditions of FY24.”

“The industry as a whole is being more conservative on production given the current volatility in the market, which we believe is a responsible approach to the long-term stability of the luxury watch market,” said the company.

For fiscal 2024, Watches of Switzerland is forecasting revenue growth of 9-12 percent at constant currency to between £1.67 billion and £1.73 billion ($2.12 billion to $2.19 billion), with EBIT margin expanding 0.2 to 0.6 percent year-over-year.

“The inherent strength of the categories we operate in, coupled with our superior business model and retail expertise continues to set us apart. We remain focused on executing our long-range plan and are committed to the targets to more than double sales and adjusted EBIT by the end of FY28,” said Duffy.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The giant gem came from Karowe, the same mine that yielded the 1,109-carat Lesedi La Rona and the 1,758-carat Sewelô diamond.

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

Supplier Spotlight Sponsored by GIA

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

The gemstone company is moving to the Ross Metal Exchange in New York City’s Diamond District.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.