Kering’s Jewelry Brands a Bright Spot in Tough Q1

The luxury titan posted declining sales, weighed down by Gucci’s poor performance.

The luxury titan reported first-quarter revenue of €4.5 billion ($4.8 billion), down 11 percent year-over-year (10 percent on a comparable basis).

The company had warned investors in a preliminary results announcement in March about its expected revenue drop, attributing it to a steep sales drop at Gucci.

The brand performed poorly, particularly in the Asia-Pacific region, with first-quarter revenue falling 21 percent (18 percent on a comparable basis).

“Kering’s performance worsened considerably in the first quarter,” said Kering CEO François-Henri Pinault.

“While we had anticipated a challenging start to the year, sluggish market conditions, notably in China, and the strategic repositioning of certain of our houses, starting with Gucci, exacerbated downward pressures on our topline.”

However, its jewelry houses, which include Boucheron and Pomellato, put on a strong performance, said Kering, with revenue up double digits in the quarter.

The company’s jewelry brands fall into its “other houses” division, alongside Alexander McQueen and Balenciaga.

For the first quarter, revenue in the division totaled €824 million ($882 million), down 7 percent year-over-year (6 percent on a comparable basis).

Boucheron and Pomellato performed especially well in the Asia-Pacific region and Japan, said Kering Chief Financial Officer Armelle Poulou on the company’s earnings call Tuesday afternoon.

Boucheron led the charge as it celebrated the 20th anniversary of its “Quatre” collection, while Pomellato debuted its “Pom Pom Dot” reversible jewels collection.

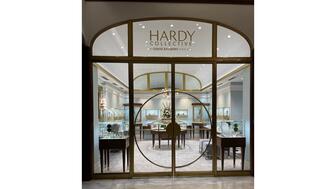

Qeelin continued to expand its presence, opening four stores.

Revenue from Kering’s directly operated stores, which includes its e-commerce sites, was down 11 percent year-over-year on a comparable basis, impacted by lower foot traffic.

Revenue in the wholesale and “other” segment was down 7 percent on a comparable basis, as the company streamlines its distribution.

Looking at its performance by region, Kering’s sales in North America fell 11 percent year-over-year in the first quarter.

North America was Kering’s third-largest market by revenue percentage in the first quarter, accounting for 22 percent of total revenue, up from 21 percent in Q1 2023.

Japan saw the strongest growth with quarterly revenue up 16 percent.

The Asia-Pacific region saw the steepest decline, down 19 percent, which Kering attributed to “challenging, volatile market conditions.”

Sales in Western Europe were down 9 percent.

Kering operated 1,781 stores as of Q1, up from 1,771 at the end of the previous fiscal year.

Looking to the year ahead, the company expects it will continue to struggle in the first half.

“The first half of the year is proving even tougher than we expected,” said Poulou.

Kering will continue to invest in its brands, she said, but will be more selective and demanding about a return on investment.

The company is expecting a sharp drop in first-half profit, forecasting a decline of 40 to 45 percent in first-half operating income.

“All of us are working tirelessly to see Kering through the current challenges and rebuild a solid platform for enduring growth,” said Pinault.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The giant gem came from Karowe, the same mine that yielded the 1,109-carat Lesedi La Rona and the 1,758-carat Sewelô diamond.

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

Supplier Spotlight Sponsored by GIA

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

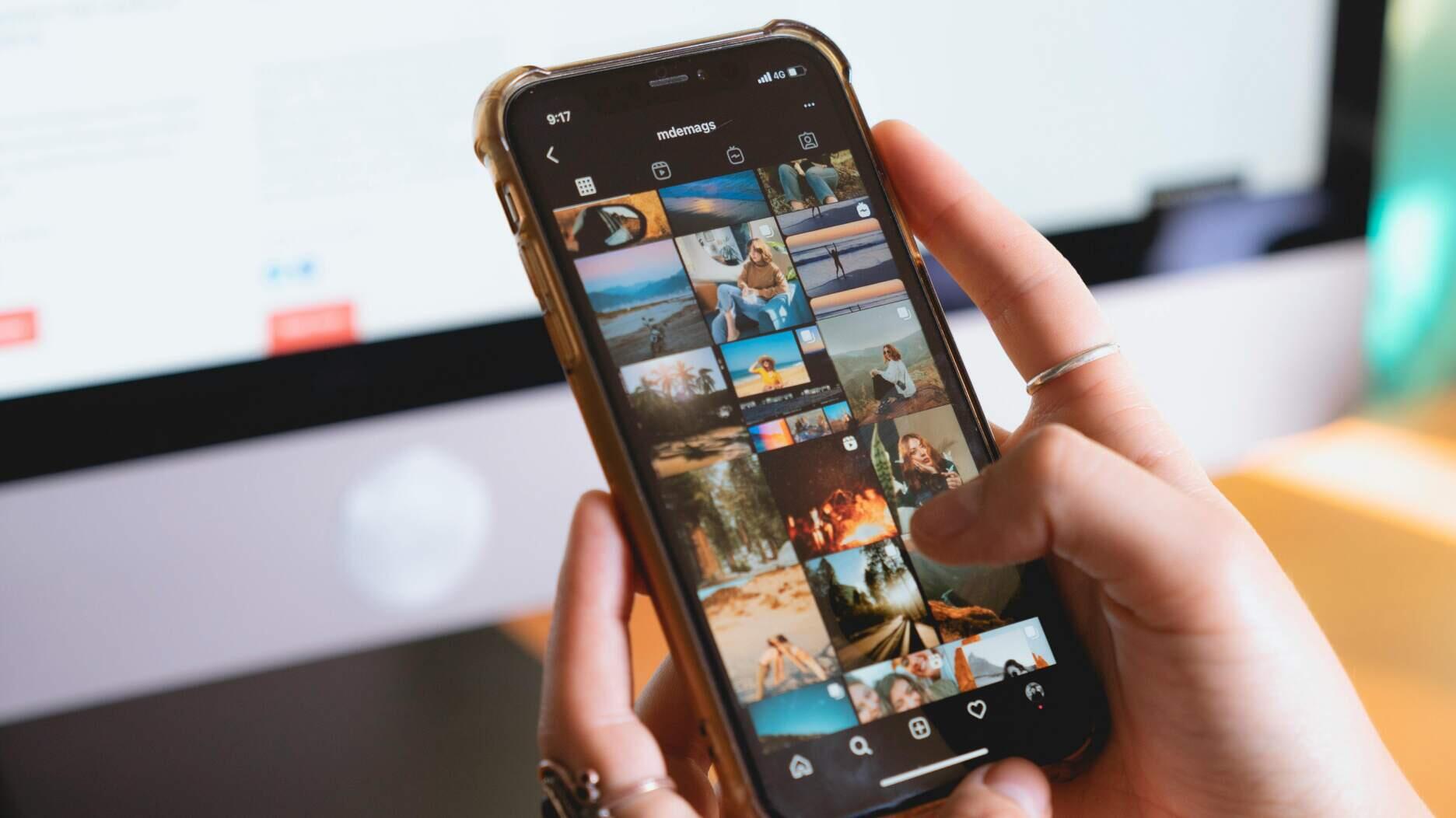

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

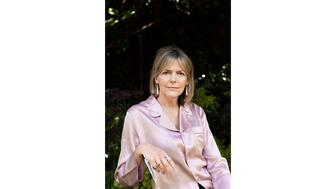

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

The gemstone company is moving to the Ross Metal Exchange in New York City’s Diamond District.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.