5 Things to Know About Pandora’s Latest Results

From lab-grown diamond sales to its holiday performance, these are the key takeaways from the jeweler’s 2023 performance.

In its report on its full-year results, released Wednesday, the company delved into its holiday performance, lab-grown diamond sales, expansion plans, and its outlook for the year ahead.

Here are five key takeaways from the report.

Pandora had a good year.

Fourth-quarter revenue was up 10 percent year-over-year at actual exchange rates to 10.82 billion Danish kroner ($1.56 billion). It reported organic sales growth (excluding the impact of currency fluctuations) of 12 percent year-over-year, with like-for-like growth of 9 percent.

For the full year, revenue totaled 28.14 billion Danish kroner ($4.06 billion) at actual exchange rates.

Organic sales growth was 8 percent, above its guidance of 5 to 6 percent.

Like-for-like sales were up 6 percent.

Pandora CEO Alexander Lacik said, “We are very pleased with how we ended 2023 with strong trading across the holiday season.”

He touted the success of Pandora’s ongoing turnaround plan, dubbed “Phoenix,” even amid a “challenging” retail environment.

“Looking back at the past two years since we launched the Phoenix growth strategy, we are proud of how our strategic initiatives have come together to consistently drive strong results despite the challenging macroeconomic backdrop.”

Sales in the United States were up 13 percent at actual exchange rates in Q4 (15 percent at organic growth rates), accounting for 29 percent of the company’s total revenue.

For the full year, U.S. sales were up 5 percent at actual and organic growth rates, accounting for 30 percent of revenue.

A new campaign bolstered its holiday sales.

Pandora noted “solid growth” across geographies and collections, highlighting its new holiday campaign, “Loves, Unboxed,” as a primary growth driver.

It credited the campaign for driving an increase in traffic for Black Friday and Christmas.

Throughout the holiday season, Pandora ran the campaign on social media, noting particular interest in its tennis bracelets.

The campaign was accompanied by a special holiday “unboxing” event at the Sphere in Las Vegas and Pandora’s sponsorship of the British Fashion Awards in December.

Pandora recently launched a new campaign, “Be Love,” starring brand ambassadors Selma Blair and Chloe and Halle Bailey.

Its lab-grown diamond sales are climbing.

Pandora’s lab-grown diamonds were especially popular in Q4 with sales up 40 percent year-over-year.

For the full year, sales grew 24 percent.

Pandora now has four lab-grown diamond collections available in more than 70 stores in the U.S., Canada, U.K., Australia, Mexico, and Brazil.

Pandora said North America continued to account for the largest proportion of lab-grown diamond jewelry sales. Rings were the top-performing category, accounting for nearly half of all sales in Q4.

“Pandora will continue to optimize execution and take learnings going forward as it looks to be the go-to destination for lab-grown diamonds,” the company said.

Its other collections posted growth as well.

Pandora’s core segment, which includes its “Moments” and “Me” collections, as well as its collaborations, saw sales up 5 percent in the quarter and 4 percent for the year.

Its “fuel with more” segment, which includes its lab-grown diamond jewelry as well as its “Timeless” and “Signature” collections, saw sales up 26 percent in the quarter and 17 percent for the year.

Pandora’s store network expansion continues.

In Q4, the company opened 72 concept stores and 69 Pandora-owned shop-in-shops.

For the full year, net openings totaled 109 concept stores and 114 Pandora owned shop-in-shops.

“The net concept store openings have been relatively broad-based, mainly across the Americas and Europe, while the openings of Pandora owned shop-in-shops have been concentrated around Latin America,” the company said.

Looking to the year ahead, Pandora plans to open 75 to 125 net concept stores and 25 to 50 shop-in-shops.

It’s continuing to roll out its new store concept, Evoke 2.0, which incorporates a simplified layout and centers around personalization, including engraving services.

The company began testing the new store concept in late 2021 in Milan and London.

In 2023, Pandora opened 55 Evoke 2.0 stores, including refurbishments, and will scale up the rollout this year.

The company hopes 60 percent of its company-owned stores will be updated to Evoke 2.0 by 2026.

Pandora operated 2,651 concept stores as of Q4 as well as 4,035 other points of sale, including 578 owned by Pandora.

The company is uncertain how 2024 will play out.

Looking to the year ahead, Pandora expressed cautious optimism.

“The economic outlook for 2024 continues to remain uncertain,” said the company. “Continued inflation and still-high interest rates suggest another challenging backdrop for consumers across many markets.”

However, it plans to carry on with its Phoenix strategy and is aiming for growth in the year ahead.

The company is forecasting organic growth of 6 to 9 percent in 2024, with the low end of the guidance accounting for a potential decline in macroeconomic conditions, and an EBIT margin of around 25 percent.

Pandora is scheduled to report its interim first-quarter results on May 2.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The giant gem came from Karowe, the same mine that yielded the 1,109-carat Lesedi La Rona and the 1,758-carat Sewelô diamond.

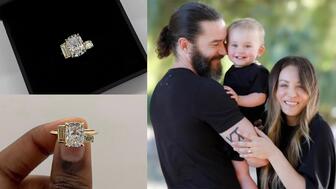

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

Supplier Spotlight Sponsored by GIA

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

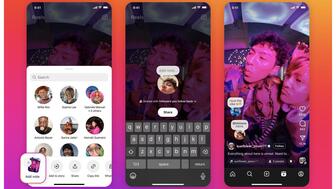

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

The gemstone company is moving to the Ross Metal Exchange in New York City’s Diamond District.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.