Signet Jewelers’ Q3 Sales Down 12%

The retailer is still expecting a strong holiday season with improving demand for natural diamonds.

During an earnings call this morning, Signet CEO Virginia C. Drosos said fine jewelry is “experiencing its second COVID,” referencing the initial struggles to make sales during the early days of the pandemic, but said she is confident a rebound is ahead.

The jewelry giant, which is the parent company of several large jewelry store chains including Zales, Jared, and Kay Jewelers, noted an uptick in the number of engagement rings sold through Black Friday weekend.

Engagement units have begun to rebound in recent weeks, said Drosos, who reiterated the retailer’s prediction of a gradual three-year recovery.

Signet’s data shows engagements typically occur within three years of a couple dating, a trend that was interrupted by the COVID-19 pandemic resulting in fewer engagements this year.

However, the number of engagements is expected to pick up later in fiscal 2024, with a more robust rebound expected in fiscal 2025.

For the quarter ending Oct. 28, Signet’s sales totaled $1.4 billion, down 12 percent year-over-year but at the high end of its sales forecast for the quarter of $1.36 billion to $1.41 billion.

Same-store sales fell 12 percent.

Drosos noted the third quarter is usually unimpressive as it’s the one quarter without a major gifting holiday and is also when the company is investing in marketing for the upcoming holiday season.

In the first nine months of the year, Signet’s sales have totaled $4.67 billion, down 10 percent year-over-year.

Same-store sales in this period were down 13 percent.

In North America, Signet’s banners include Zales and Kay Jewelers as well as Peoples in Canada.

Signet’s third-quarter sales in the region totaled $1.3 billion, down 12 percent year-over-year.

Same-store sales also were down 12 percent.

Signet’s international banners include Ernest Jones and H. Samuels.

International sales totaled $94 million, down 1 percent year-over-year. Same-store sales were down 5 percent.

The company recently sold 15 Ernest Jones stores to Watches of Switzerland, with the accretive sale multiple generating proceeds of $53 million, which will add $12 million for Signet in Q4.

Signet said it may sell six additional Ernest Jones to Watches of Switzerland stores in the fourth quarter.

“The divestiture of this non-strategic business allows Signet to more quickly apply key elements of our U.K. transformation plan,” said the company.

Drosos forecast strong demand for natural diamonds as the oversupply begins to abate, adding that De Beers’ recent marketing investment should bolster the category.

While engagement ring sales are down, custom jewelry, particularly from Jared Foundry, has been popular, with unit growth up 40 percent in the quarter for those stores.

Over Black Friday weekend, jewelry under $1,000 remained popular, with the Banter by Piercing Pagoda banner doing particularly well.

Signet’s services category, which includes its extended service agreements, customization, repairs, and piercings, has continued to grow, with sales up 5 percent in the quarter and year-to-date.

In July, Signet Jewelers announced it had acquired the assets of the Service Jewelry Repair National Repair Center, or SJR, allowing it to bring more repairs in-house.

Looking to the holiday season, Drosos said, “Jewelry continues to be an important gifting category, particularly among Gen Z.”

For fiscal 2024, Signet lowered its guidance slightly to reflect the loss of an estimated $25 million in revenue after selling the 15 Ernest Jones stores to Watches of Switzerland.

It now expects sales of $7.07 billion to $7.27 billion, compared with its prior guidance for sales of $7.1 billion to $7.3 billion.

In the fourth quarter, the company is expecting sales of $2.4 billion to $2.6 billion.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The giant gem came from Karowe, the same mine that yielded the 1,109-carat Lesedi La Rona and the 1,758-carat Sewelô diamond.

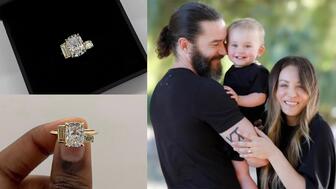

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

Supplier Spotlight Sponsored by GIA

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

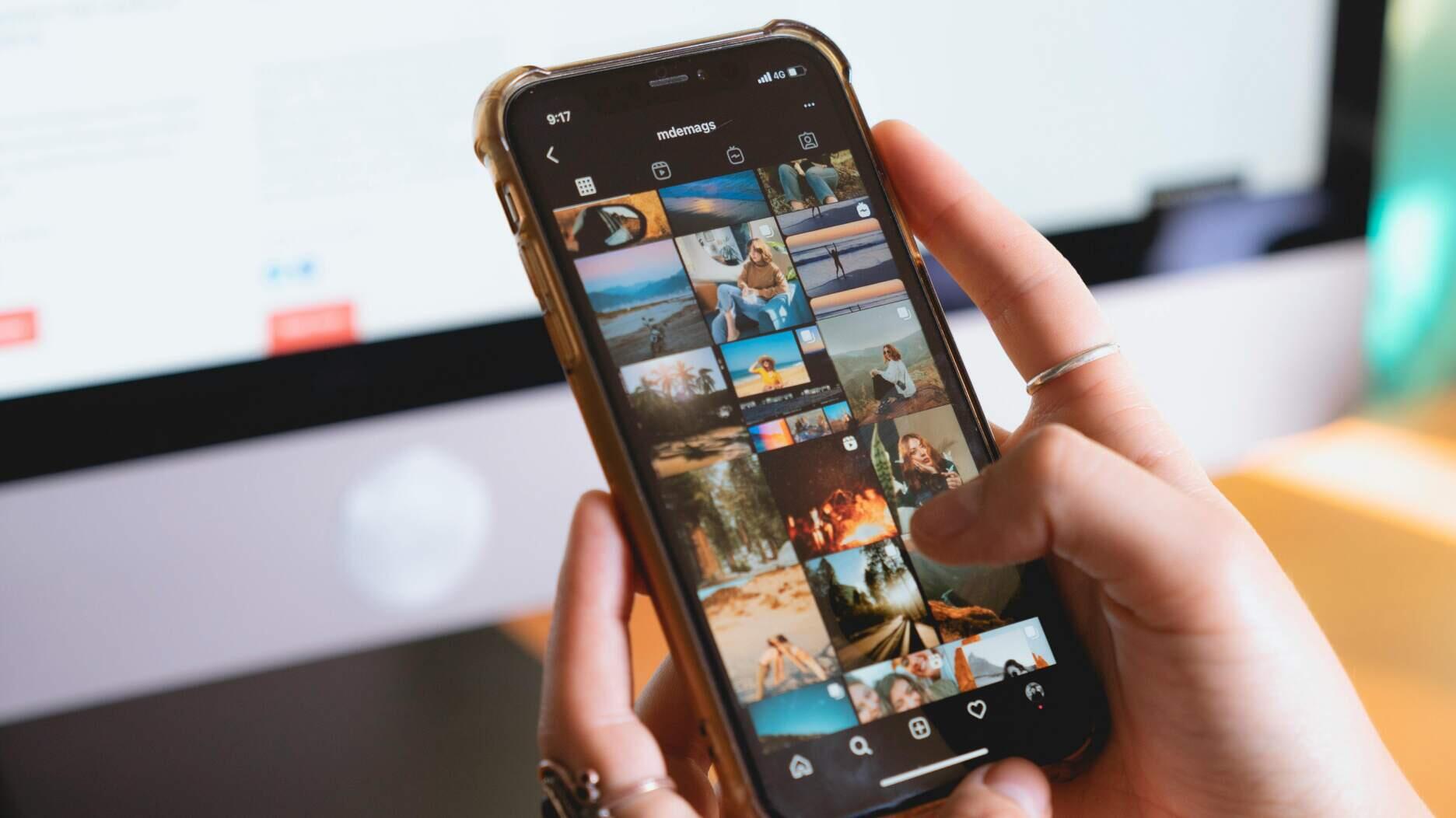

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

The gemstone company is moving to the Ross Metal Exchange in New York City’s Diamond District.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

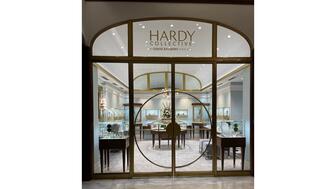

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.