Consumer Confidence in January Highest Since End of 2021

The Conference Board attributed the upbeat results to slowing inflation and the anticipation of lower interest rates.

The Conference Board’s consumer confidence index rose to 114.8 in January from a downwardly revised 108.0 in December.

“January’s increase in consumer confidence likely reflected slower inflation, anticipation of lower interest rates ahead, and generally favorable employment conditions as companies continue to hoard labor,” said Dana Peterson, chief economist at The Conference Board.

The gain was seen across all age groups, but largest for consumers 55 and over, said Peterson.

Confidence improved for all income groups except those at the top. Households earnings $125,000 or more saw a slight decline.

Consumers are still concerned about rising prices, according to write-in responses, but inflation expectations fell to a three-year low.

However, plans to make big purchases were down. On a month-to-month and six-month basis, buying plans for autos, homes, and big-ticket appliances were down in all three categories.

Respondents continued to favorably rate their income and personal finances over the next six months.

As for a recession, its “Consumers’ Perceived Likelihood of a US Recession over the Next 12 Months” metric “gradually eased” in January, The Conference Board said.

The Present Situation Index, which measures consumers’ current view of business and labor market conditions, soared to 161.3 from 147.2 in December.

Peterson attributed the climb to more positive views of business conditions and employment.

When asked to assess their current family financial conditions (a measure not included in calculating the Present Situation Index), more people said “good” and fewer people said “bad.”

“This suggests consumers are starting off the year in good spirits about their current finances,” said Peterson.

Consumers’ view of current business conditions was more positive in January, with the percentage of respondents who said current business conditions are “good” up to 23 percent from 21 percent, while those who said conditions are “bad” decreased to 14 percent from 17 percent.

Consumers also had a positive view of the current labor market.

The percentage of respondents who felt jobs were plentiful was up to 46 percent in January from 40 percent, while 10 percent said jobs were “hard to get,” down from 13 percent.

The Expectations Index, which measures consumers’ outlook for income, business, and labor market conditions in the near future, rose to 83.8 from the downwardly revised 81.9 in December.

The index went up due to “receding pessimism around future business conditions, labor market, and income prospects,” said Peterson.

Expectations that interest rates will rise in the year ahead “plummeted,” said the organization.

The average 12-month inflation expectations fell to 5.2 percent, the lowest since March 2020 (4.5 percent).

The number of consumers that expect stock prices to be higher in the year ahead was down slightly after a December surge but remained near three-year highs.

Looking at short-term business conditions, respondents’ outlooks were more pessimistic, with 17 percent of respondents expecting business conditions to improve, down from 19 percent in December, while 16 percent expected them to worsen, down from 18 percent.

Consumers’ assessment of the short-term labor market outlook in December was mixed.

The percentage of respondents who expect more jobs to be available was down to 16 percent from 18 percent in December, while 15 percent expect fewer jobs to be available, down from 18 percent.

Consumers’ short-term income expectations were also mixed.

Fewer respondents expect to see their incomes increase (16 percent in January versus 18 percent in December) while 12 percent expect their incomes to decrease, down from 14 percent in December.

The Conference Board recently added a set of questions to its monthly survey, asking consumers how they felt about their family finances.

In January, consumers’ views of their families’ current financial situation were more positive while views of the six-month situation remained optimistic.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The giant gem came from Karowe, the same mine that yielded the 1,109-carat Lesedi La Rona and the 1,758-carat Sewelô diamond.

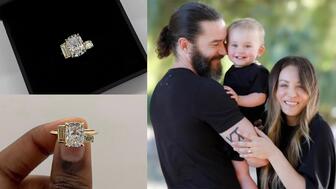

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

Supplier Spotlight Sponsored by GIA

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

The gemstone company is moving to the Ross Metal Exchange in New York City’s Diamond District.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

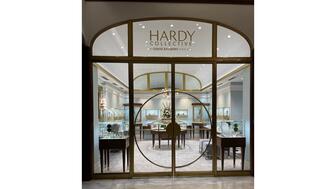

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.