Holiday Shoppers Broke a Record This Weekend, Says NRF

From Thanksgiving through Cyber Monday, 200.4 million consumers shopped online and in stores.

From Thanksgiving through Cyber Monday, 200.4 million consumers went shopping, exceeding the organization’s expectation of 182 million and surpassing last year’s 196.7 million shoppers.

“We had a very big weekend,” said NRF CEO Matthew Shay on a media call Tuesday morning, adding that NRF “continues to expect a healthy, strong holiday season.”

NRF, in partnership with Prosper Insights & Analytics, surveyed 3,498 adult consumers from Nov. 22-26 about their holiday weekend spending.

Here are five key takeaways from the annual survey.

Black Friday reigns supreme.

Black Friday is still the king of shopping days with 76.2 million shoppers heading to brick-and-mortar stores, up from 72.9 million in 2022.

Fewer shoppers were in stores on Saturday, down to 59 million from 63.4 million last year.

Similar to last year, 78 percent of Saturday shoppers shopped specifically for Small Business Saturday.

Online shopping gained even more popularity.

Throughout the five-day period, online shopping was the most popular option, chosen by 134.2 million shoppers, up from 130.2 million last year.

Fewer people opted for in-store shopping this year, down to 121.4 million from 122.7 million in 2022.

Black Friday was the most popular day for online shopping, as it has been since 2019, said NRF.

Around 90.6 million consumers shopped online on Black Friday, up from 87.2 million in 2022.

Cyber Monday, the day known for its online deals, saw 73 million online shoppers, down from 77 million last year.

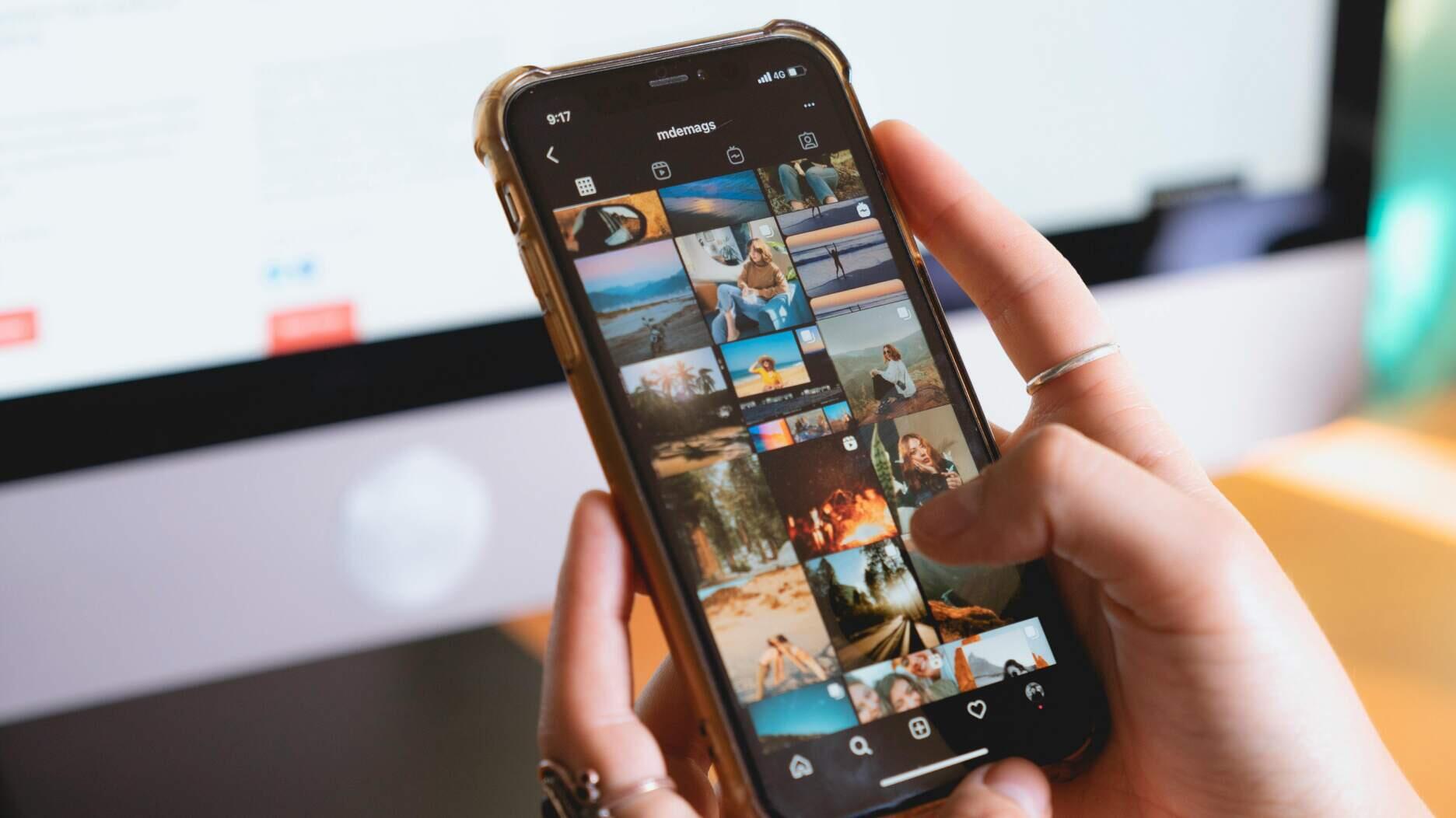

Fewer people shopped on their mobile devices, down to 40.5 million from the record of 45.7 million in 2022, though still above the pre-pandemic level.

About 44 million consumers used their home desktop or laptop to shop online on Cyber Monday, in line with last year’s figures.

The top destinations for holiday shoppers were online (44 percent) followed by grocery stores and supermarkets (42 percent), department stores (40 percent), clothing and accessories stores (36 percent) and electronics stores (29 percent).

Shoppers spent less on average this year.

Shoppers spent an average of $321.41 on holiday-related purchases this weekend, down from $325.44 last year. Of this spending, 70 percent went to gifts.

NRF does not adjust its calculations for inflation.

Through the weekend, 95 percent of shoppers made holiday-related purchases, down from 97 percent last year, but in line with historical levels, said NRF.

NRF said it does not include purchases made over the long weekend that are not holiday related, like home goods.

The organization expects overall holiday spending to reach record levels in 2023, with year-over-year growth of 3 to 4 percent, pushing the sales total to $957.3 billion to $966.6 billion.

While that’s a slower growth rate than it’s seen in recent years, it is consistent with the average annual holiday increase of 3.6 percent seen each year from 2010 to 2019, said NRF CEO Shay during the holiday forecast call earlier this month, adding that trillions of dollars in stimulus sparked “unprecedented” rates of retail spending from 2020 to 2022.

The numbers are still good “on a historic basis,” he said on Tuesday’s call, adding “there’s a difference between moderation and bleak.”

Consumers have been “more intentional and deliberate” with purchases in recent quarters, said Shay.

Clothing and accessories were the most popular gifts.

As for what people were buying, clothing and accessories were in the top spot at 49 percent.

Toys came in second (31 percent), followed by gift cards (25 percent), books, video games and other media (23 percent), and personal care or beauty items (23 percent).

This year was the first time personal care or beauty items made the top five list.

Holiday sales were persuasive.

More than half (55 percent) of holiday weekend shoppers said their purchases were driven by sales and promotions, up from 52 percent last year.

Thirty-one percent said a limited-time sale or promotion “convinced them to make a purchase they were hesitant about,” up from 29 percent in 2022.

Retailers have been responding to the demand for earlier holiday shopping with sales and promotions this season, said NRF.

More than half (55 percent) said they took advantage of these early sales, with 35 percent shopping the week before Thanksgiving (Nov. 16-22).

As of Thanksgiving weekend, most consumers (85 percent) had started holiday shopping.

Nearly half of consumers (48 percent) said they were halfway done with their shopping, leaving opportunity for retailers in the weeks ahead.

NRF defines the holiday season as Nov. 1 through Dec. 31 and has forecast that holiday spending is expected to reach record levels, growing between 3 percent and 4 percent, totaling $957.3 billion to $966.6 billion.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The giant gem came from Karowe, the same mine that yielded the 1,109-carat Lesedi La Rona and the 1,758-carat Sewelô diamond.

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

Supplier Spotlight Sponsored by GIA

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

The gemstone company is moving to the Ross Metal Exchange in New York City’s Diamond District.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.