Here’s What NRF Is Forecasting for the Holiday Season

Sales will increase compared with last year, though the rate of growth is expected to slow.

Holiday spending is expected to reach record levels in 2023, with year-over-year growth of 3 to 4 percent pushing the sales total to $957.3 billion to $966.6 billion, the organization announced during its annual holiday sales forecast media call.

The year-over-year growth rate is expected to be lower than in recent years, with 2022 holiday sales up 5 percent, 2021 sales up 13 percent, and 2020 sales up 9 percent.

However, the 2023 spending forecast is consistent with the average annual holiday increase of 3.6 percent from 2010 to 2019, said NRF, adding that trillions of dollars in stimulus sparked “unprecedented” rates of retail spending from 2020 to 2022.

NRF defines the holiday season as Nov. 1 through Dec. 31, and focuses on core retail, excluding automobile dealers, gasoline stations, and restaurants.

NRF CEO Matthew Shay opened the holiday sales call on a positive note.

“In spite of the uncertainty of the economy and the challenges households are facing, we’ve seen strength and resilience across the consumer sector,” he said.

Consumers are grappling with inflation, rising interest rates, and higher gas prices, yet they’ve continued to spend.

“Consumer spending, which makes up approximately 70 percent of our economic activity, has kept the economic expansion on a steady and solid path forward,” said Shay.

NRF Chief Economist Jack Kleinhenz noted the rise in spending on services.

“For all that the consumer has kept the economy afloat, the composition of spending from goods to services will also define holiday sales trends,” he said in a press release.

“Service spending growth is strong and is growing faster than goods spending. The amount of spending on services is back in line with pre-pandemic trends.”

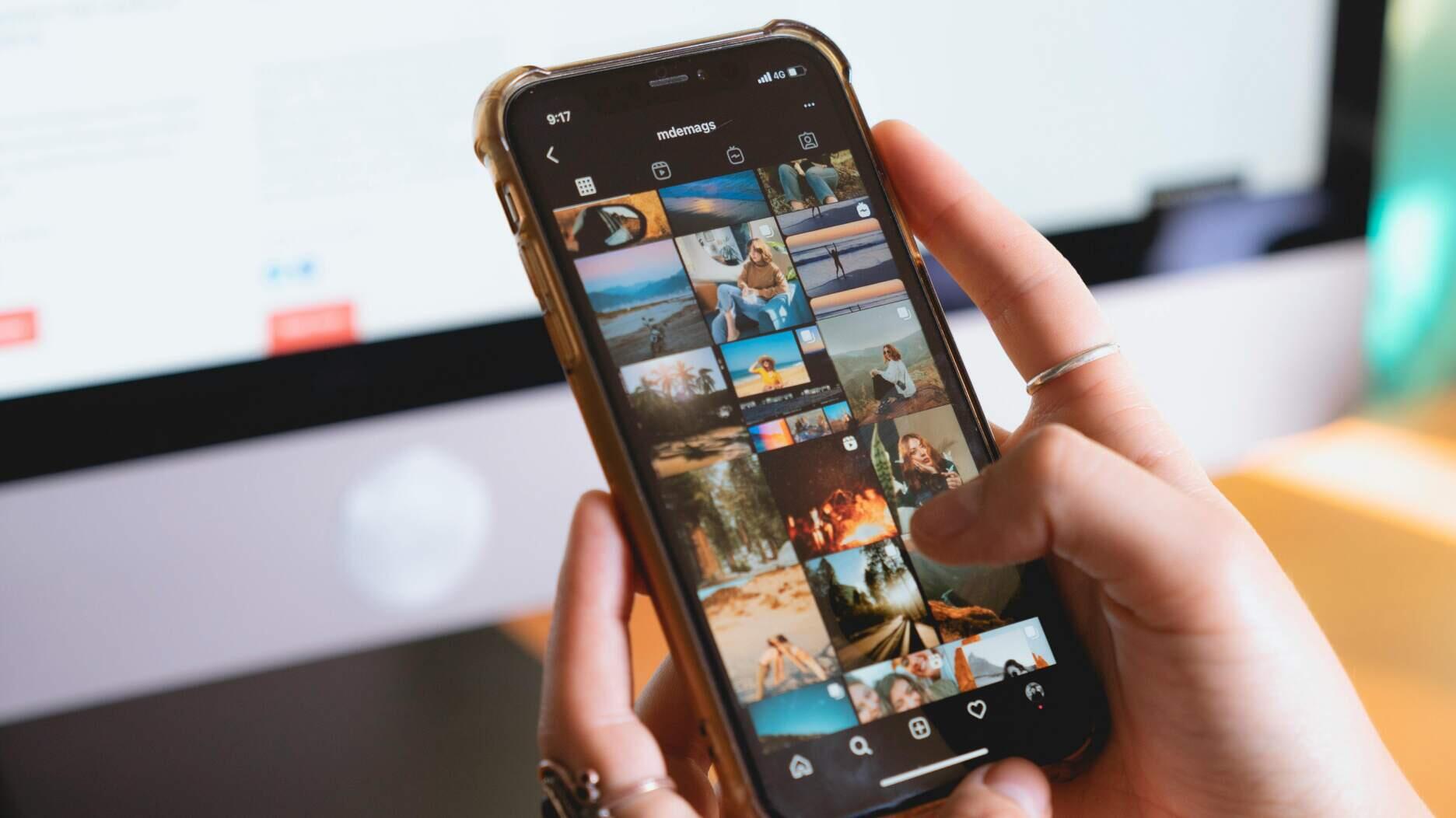

As for where consumers will shop, online will remain a popular option. Online and other non-store sales, which are included in the total, are expected to increase between 7 and 9 percent to $273.7 billion to $278.8 billion, up from $255.8 billion last year.

To meet the holiday demand, retailers are expected to hire between 345,000 and 450,000 seasonal workers, in line with 391,000 seasonal hires in 2022.

As holiday shopping begins earlier, a trend in recent years, some of this hiring may have been pulled into October, noted NRF.

A recent NRF holiday survey found that 43 percent of holiday shoppers planned to make purchases before November.

“We see this every year in the work we do looking at consumer behavior. There are consumer attitudes and then there are consumer actions, and inflation impacts their attitudes.”— Matthew Shay, National Retail Federation

During the call, Shay and Kleinhenz also shed light on why consumer spending is up despite the fact that consumer confidence is down.

“This disconnect has been going on all year where consumer confidence and sentiment have been at very low levels that don’t seem consistent with what consumers are doing,” said Kleinhenz.

Though consumers are still positive about their household finances and job security, he said, inflation is taking its toll on their outlooks.

“We were in a period of time for almost 10 years where there was zero inflation. I think there are many households, probably young households, that have no recollection of what it was like.”

He also added that people’s political views can inform how they view the economy’s performance.

If, for example, the party you identify with is in power, you may view the economy more favorably, while those in the opposing party may take a more negative view.

Shay echoed Kleinhenz’s take on the impact of inflation.

“We see this every year in the work we do looking at consumer behavior. There are consumer attitudes and then there are consumer actions, and inflation impacts their attitudes.”

He said consumers still will go out and spend money if they have jobs and receive pay increases.

“As long as the job market is as strong as it is, the actions are going to continue to power the economy,” said Shay.

Though some headwinds retailers and shoppers alike can foresee, there may be some “unpredictable impacts” from winter weather on the way.

“This year, holiday retail spending may experience residual effects from El Niño, depending on the strength and persistence of the weather phenomena,” NRF noted.

NRF will conduct a separate survey about the holiday weekend forecast that will include Black Friday sales predictions.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The giant gem came from Karowe, the same mine that yielded the 1,109-carat Lesedi La Rona and the 1,758-carat Sewelô diamond.

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

Supplier Spotlight Sponsored by GIA

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

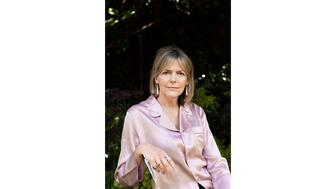

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

The gemstone company is moving to the Ross Metal Exchange in New York City’s Diamond District.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

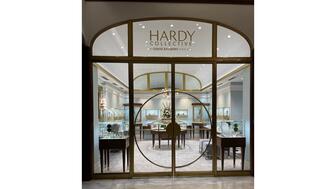

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.