Consumer Confidence Is Down Yet Shoppers Continue to Spend

The Conference Board’s monthly index that measures how consumers are feeling declined for the third straight month in October.

The Conference Board’s consumer confidence index decreased to 102.6 in October from an upwardly revised 104.3 in September.

“Write-in responses showed that consumers continued to be preoccupied with rising prices in general, and for grocery and gasoline prices in particular,” said Dana Peterson, chief economist at The Conference Board.

Consumers also shared concerns about politics and higher interest rates as well as ongoing conflicts, including the Israel-Hamas War.

“The decline in consumer confidence was evident across household [members] aged 35 and up, and not limited to any one income group,” said Peterson.

The Present Situation Index, which measures consumers’ current view of business and labor market conditions, declined to 143.1 from 146.2 in September.

“Assessments of the present situation were driven by less optimistic views on the state of business conditions, but consumers’ rating of current job availability held steady,” said Peterson.

Consumers’ view of current business conditions was more pessimistic in October, with the percentage of respondents who said current business conditions are “good” down to 19 percent from 21 percent in September, while those who said conditions are “bad” increased to 18 percent from 16 percent.

Consumers had a mixed view of the current labor market.

The percentage of respondents who felt jobs were plentiful was virtually flat at about 40 percent in October, while 13 percent said jobs were “hard to get,” down from 14 percent in September.

The Expectations Index, which measures consumers’ outlook for income, business, and labor market conditions in the near future, fell slightly to 75.6 from 76.4 in September.

When expectations fall below 80, that historically signals a recession within the next year, said the Conference Board, a prediction it first made in July.

“Consumer fears of an impending recession remain elevated, consistent with the short and shallow economic contraction we anticipate for the first half of 2024,” said the Conference Board.

Peterson noted that two-thirds of consumers said a recession is “somewhat” or “very likely” in October.

“The fluctuating soundings likely reflect ongoing uncertainty given mixed buying plans. On a six-month moving average basis, plans to purchase autos and appliances rose while plans to buy homes—in line with rising interest rates—continued to trend downward,” she said.

“The continued skepticism about the future is notable given U.S. consumers, at least through the third quarter of this year, continued to spend heavily on both goods and services,” she noted.

Looking at short-term business conditions, respondents’ outlooks were more pessimistic, for the most part.

Seventeen percent of respondents expected business conditions to improve, up from 15 percent in September, but 20 percent expected them to worsen, up from 19 percent.

Consumers’ assessment of the short-term labor market outlook in October was about the same as it was in September.

The percentage of respondents who expect more jobs to be available was nearly flat at 16 percent while 19 percent expect fewer jobs to be available, also flat month-over-month.

Consumers’ short-term income expectations were down while prospects were up slightly.

Fewer respondents expect to see their incomes increase (16 percent in October versus 18 percent in September) while 13 percent expect their incomes to decrease, down from 14 percent.

The Conference Board recently added a new set of questions to its monthly survey, asking consumers how they felt about their family finances.

In October, consumers’ views of their families’ current financial situation improved slightly while views of the situation six months from now softened.

The consumer confidence results for November are slated to be released Nov. 28.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The giant gem came from Karowe, the same mine that yielded the 1,109-carat Lesedi La Rona and the 1,758-carat Sewelô diamond.

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

Supplier Spotlight Sponsored by GIA

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

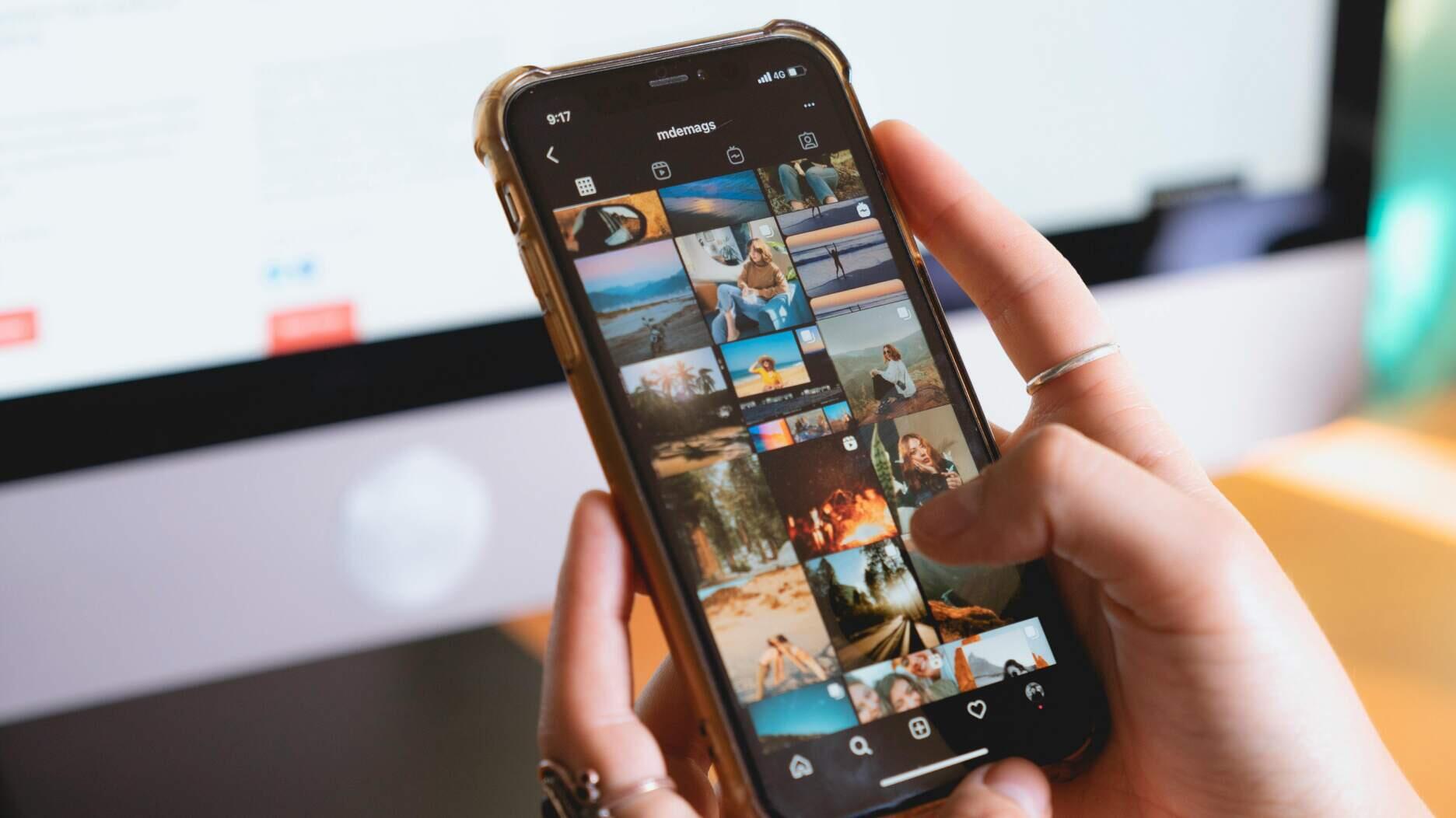

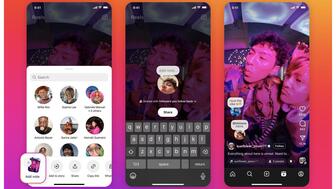

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

The gemstone company is moving to the Ross Metal Exchange in New York City’s Diamond District.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.