Mastercard Makes Its 2023 Holiday Prediction

According to SpendingPulse, retail sales will increase in November and December but not necessarily for jewelers.

Mastercard released its outlook for the 2023 holiday season last week and, like Bain & Company and Deloitte, it expects retail sales to grow, but not by much.

According to Mastercard SpendingPulse, U.S. retail sales (excluding automobiles) will increase about 4 percent year-over-year during the holiday season, defined as Nov. 1-Dec. 24.

SpendingPulse measures both online and in-store retail stores across all forms of payments (not just Mastercard purchases). It is not adjusted for inflation.

Consumer spending is expected to rise across all but one of the five categories SpendingPulse tracks—jewelry.

Jewelry sales are expected to decline 0.3 percent year-over-year amid what the company described as a “rebalancing” in consumer spending.

In 2022, there was pent-up demand. Consumers had excess savings and wages were rising while inflationary pricing aided retailers.

This year, Mastercard expects spending to normalize in line with macroeconomic trends. Demand is leveling off and consumers are finding themselves with less of a financial cushion as inflation continues to cut into their savings.

The fine jewelry industry already has begun to witness the slowdown after two years of sky-high sales.

The industry’s largest retailer, Signet Jewelers, had a rough second quarter due in part to a decline in the number of engagements while De Beers Group is spending $20 million to ensure consumers stay interested in diamonds, natural diamonds specifically.

“This holiday season, retailers will be vying for consumer dollars. With numerous choices and tightening budgets, you can anticipate shoppers to be increasingly selective and value-focused,” said Steve Sadove, senior advisor for Mastercard and former CEO and Chairman of Saks Inc.

“We expect the most effective holiday strategy will be to meet consumers where they are— personalized promotions to in-store experiences will be key in doing so.”

The two categories Mastercard SpendingPulse predicts will post the largest increases in spending this holiday season are electronics (up 6 percent year-over-year) and restaurants (up 5 percent year-over-year).

Mastercard said electronics, gadgets and gaming are expected to be popular among consumers this year, as artificial intelligence, immersive experiences, and digital workspaces continue to the change the way people work and play.

In addition, consumers who purchased new electronics at the onset of the pandemic may be looking to upgrade this year.

As for restaurant spending, the company said consumers are keen on gathering with loved ones for shared meals and festivities outside of the home after a few years of being isolated.

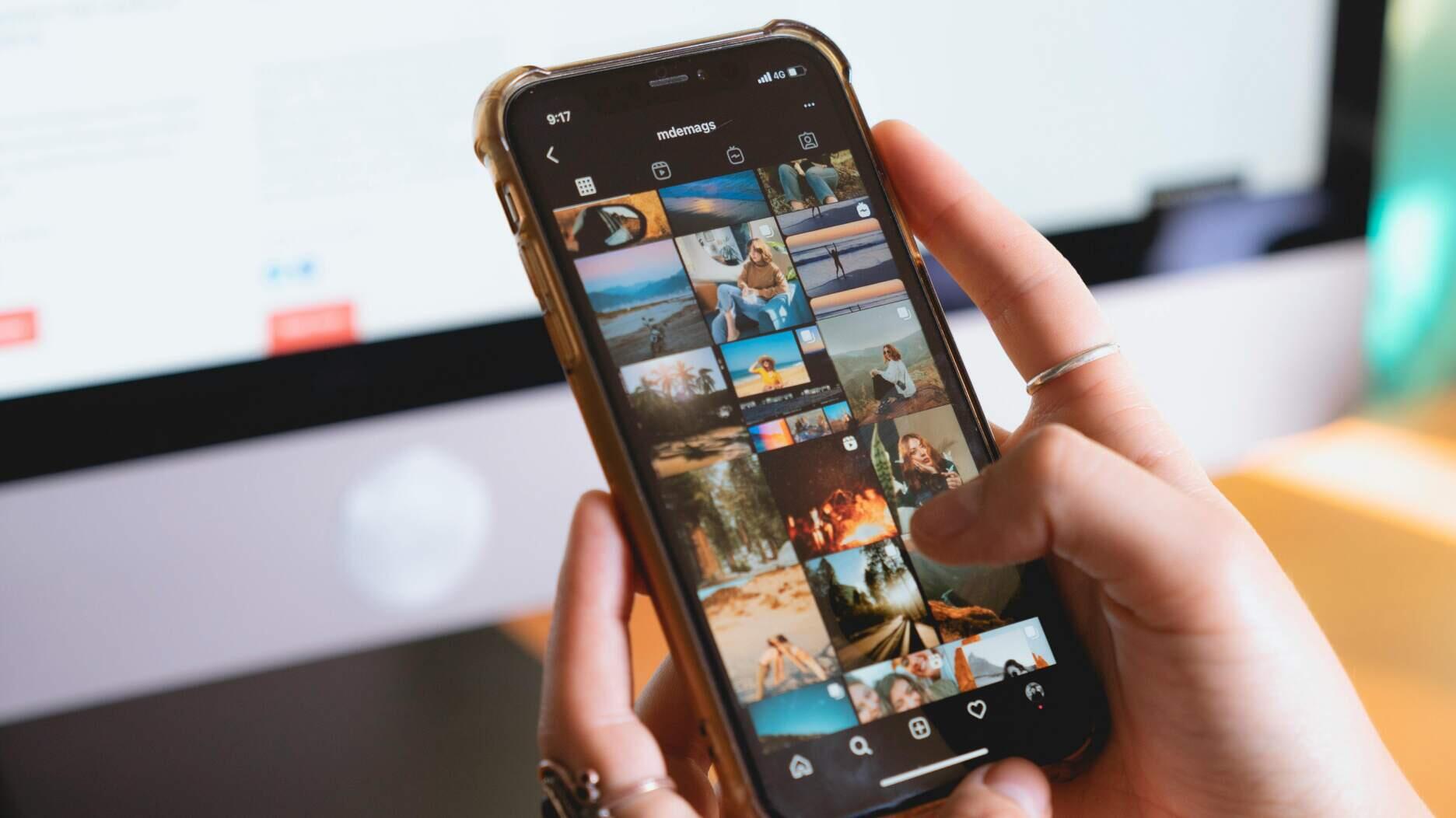

When it comes to where consumers will be shopping this holiday season, Mastercard said this season’s shopper is looking to “make purchases anytime, anywhere.”

It predicts in-store sales will increase 3 percent year-over-year while e-commerce sales are expected to grow 7 percent.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The giant gem came from Karowe, the same mine that yielded the 1,109-carat Lesedi La Rona and the 1,758-carat Sewelô diamond.

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

Supplier Spotlight Sponsored by GIA

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

The gemstone company is moving to the Ross Metal Exchange in New York City’s Diamond District.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.