Why Bain and Deloitte Think Sales Will Grow This Holiday Season

From holiday spending to inflation’s impact, here’s what analysts are forecasting for the season.

Both companies are projecting sales growth for the season, but dwindling savings and inflation may put a damper on the celebrations.

From sales predictions to thoughts on when the shopping season will begin, here are five key takeaways from their recently released 2023 holiday forecasts.

Retail sales will grow this holiday season but not much.

Bain is forecasting 3 percent growth in U.S. retail holiday sales, the lowest uptick since 2018, with sales reaching $915 billion.

Deloitte expects holiday retail sales to grow between 4 and 5 percent, with sales totaling $1.54 trillion to $1.56 trillion from November to January. Last year, sales were up 8 percent in the same period.

“We expect healthy employment and income growth to keep the volume of sales growing for the 2023 holiday season,” said Daniel Bachman, Deloitte’s U.S. economic forecaster.

“Inflation, which accounted for much of the increase in the value of retail sales last year, should moderate. This means the total value of retail sales will grow more slowly than last year.”

Bachman added that its forecast reflects dwindling pandemic-era savings, which is expected to weigh on retail sales.

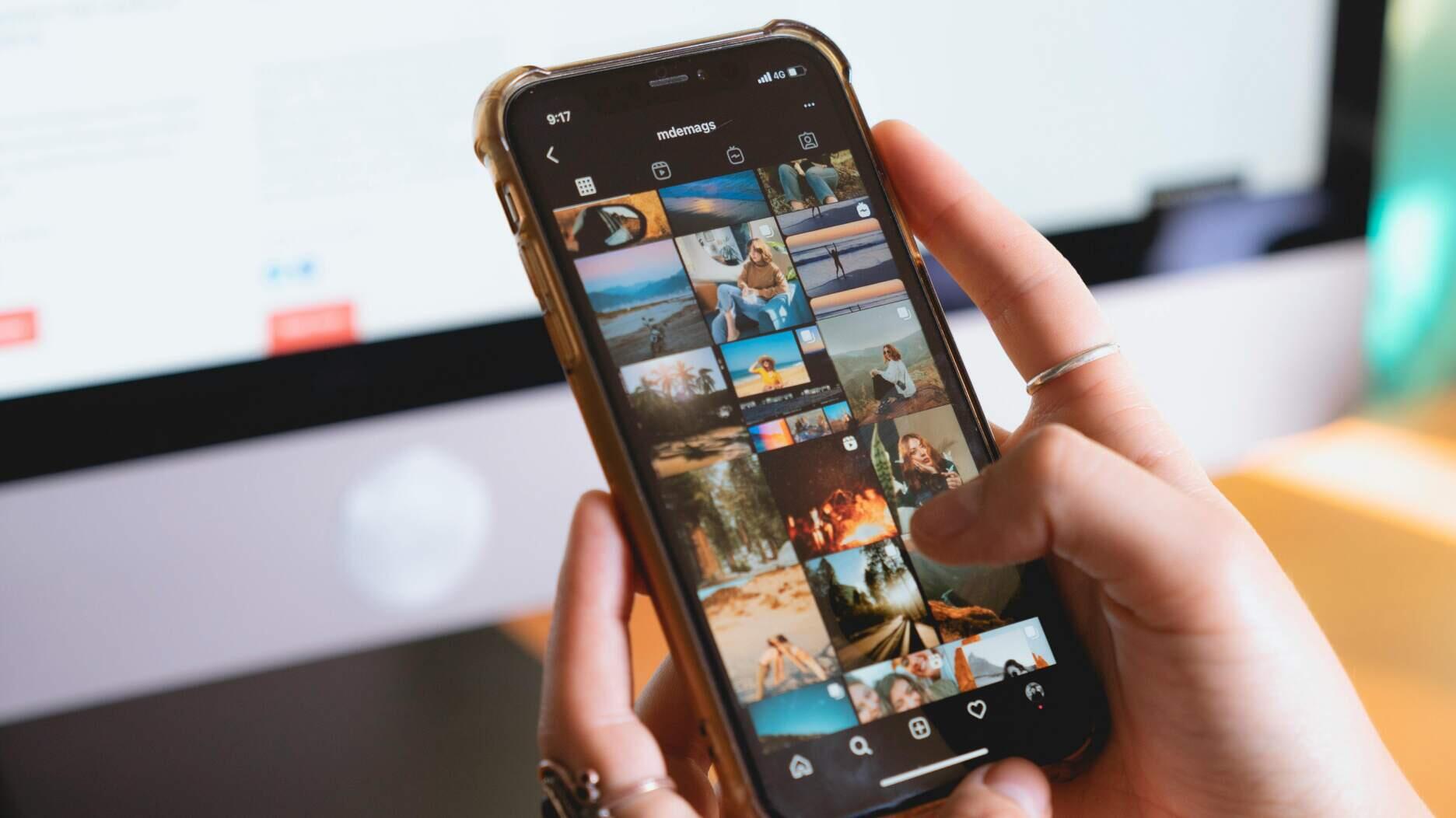

A majority of the sales growth will stem from e-commerce.

Bain predicted 3 percent growth for the season, with 90 percent of that growth coming from non-store sales, meaning e-commerce and mail order.

Deloitte forecasted e-commerce sales to grow between 10 and 13 percent year-over-year during the 2023-2024 holiday season, with sales totaling between $278 billion and $284 billion. Last year, sales grew 8 percent in the same period.

“This season, e-commerce sales should continue to be strong as consumers search for the best deals online to maximize their wallets,” said Nick Handrinos, vice chair of Deloitte LLP and U.S. retail, wholesale and distribution, and consumer products leader.

“Retailers who remain flexible to shifting consumer demand and behaviors will likely be poised for growth this holiday season.”

Bain advised retailers to “use stores to support profitable online growth—shipping, returns, and trials.”

As the cost of living increases, some will scale back holiday spending.

In its forecast, Bain highlighted “elevated nondiscretionary costs,” including housing and healthcare.

High interest rates will make spending pricier for shoppers. Debt also will be a factor in how much shoppers spend, especially as student debt payments resume.

Though inflation is slowing, said Bain, prices are higher than last year, which will boost nominal sales.

“Lead with value messages and strategic promotions to draw in cautious customers,” advised Bain.

Deloitte’s Handrinos said, “Retail sales are expected to increase even as higher prices continue to create a battle for consumer spending. A sharp rise in spending on services post-pandemic shows signs of leveling off since last year, and compared to pre-pandemic levels, spending on durable goods remains high.”

On the bright side, wages, and stocks are up year-over-year, said Bain, which will give some shoppers more disposable income.

Upper-income households, those making more than $100,000, account for 51 percent of spending.

Bain’s survey found that people in this income bracket have less “intent to spend” and higher “intent to save.”

Middle-income households, those making $50,000 to $100,000, account for 25 percent of spending. In this income bracket, people have less “intent to spend” and less “intent to save.”

Lower-income households, those making less than $50,000, account for 24 percent of spending. In this income bracket, people have higher “intent to spend” and higher “intent to save.”

For all income levels, the overall outlook for the season increased while the “intent to use debt” to finance holiday purchases decreased.

The holiday shopping season could begin as early as October.

Shoppers may start checking things off their holiday shopping list before Halloween.

Bain predicted October events could fast track holiday spending again. The group highlighted Amazon Prime Day in particular, slated for Oct. 10-11.

To compete with Amazon, Target ran its own special promotion, “Target Deal Days,” last year, and may bring back the sale this year.

“Get an early lead—shopping starts earlier, and customers could run out of budget,” Bain advised retailers.

Retailers should utilize technology to elevate marketing strategies.

As holiday sales competition heats up, retailers should make the most of every tool at their disposal.

“From gen AI [generative artificial intelligence] to livestream, new tech enables more targeted, personalized marketing,” said Bain.

“Stress positive common values to bring customers holiday joy in tough times,” Bain added.

TikTok recently released its holiday guide, including a free-to-download marketing playbook.

The platform said half of its users turn to its “For You Page” for holiday and shopping events content.

TikTok users are 1.4 times more likely to buy a product they see on the platform, the company said.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The giant gem came from Karowe, the same mine that yielded the 1,109-carat Lesedi La Rona and the 1,758-carat Sewelô diamond.

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

Supplier Spotlight Sponsored by GIA

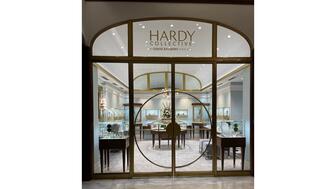

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

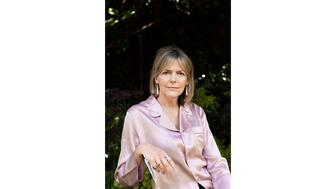

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

The gemstone company is moving to the Ross Metal Exchange in New York City’s Diamond District.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.