De Beers’ Production Drops 15% in Q2

The company also reported the $150 million sale of an iron ore royalty right, part of its ongoing effort to divest “non-core” assets.

According to the miner’s Q2 report released July 18, production dropped to 6.4 million carats from 7.6 million carats in the second quarter 2023.

In Botswana, which accounts for more than 70 percent of the company’s annual output, production fell to 4.7 million carats in the second quarter, down 19 percent from 5.8 million carats in Q2 2023.

De Beers said the drop was driven by lower production at the Jwaneng mine, where it intentionally made short-term changes to the plant feed mix in order to work through existing surface stockpiles.

Jwaneng also experienced a worker fatality. In a statement released June 18, Debswana (the joint venture between De Beers and the Botswana government) said the worker was killed in an accident involving a crane and drill rig on the morning of June 17.

“An investigation to understand the circumstances surrounding the incident is ongoing and relevant stakeholders will be updated accordingly,” the statement reads.

“Debswana is providing full support to the family and we kindly request that they be accorded due respect and privacy during this difficult time.”

Production in Namibia fell 8 percent year-over-year from 612,000 carats to 561,000, due in part to planned vessel maintenance at Debmarine Namibia.

In South Africa, production rose 8 percent, jumping from 466,000 carats in the second quarter last year to 505,000 carats.

De Beers attributes the increase to processing more higher-grade underground ore as it continues to transition its only remaining mine in the country, Venetia, to an underground operation.

Production in Canada was broadly unchanged at 673,000 million carats, a slight dip from 683,000 carats in Q2 last year.

While the market for rough diamonds recovered slightly at the beginning of the year, the miner said demand deteriorated in the second quarter due to higher-than-normal polished inventory in the midstream as well as retailers’ caution in restocking.

Second-quarter 2024 rough diamond sales totaled 7.8 million carats from three sights, up from 7.6 million carats from two sights in Q2 2023 and 4.9 million carats from two sights in Q1 2024.

The first-half 2024 consolidated average realized price remained broadly flat year-over-year at $164 per carat, reflecting a larger proportion of higher-value rough diamonds being sold, offset by a 20 percent drop in the average rough price index compared to H1 2023.

As previously reported, De Beers will cease rough diamond sight sale announcements following its Q2 production report. Moving forward, the miner said it will report the information quarterly.

Its 2024 production guidance, lowered in the previous quarter, remains at 26-29 million carats. Unit cost guidance also remains unchanged at $90 per carat.

Because of the congested midstream and an expected prolonged recovery, De Beers said it is seeking to further reduce production to save money.

De Beers also is working to offload non-core assets in an effort to cut costs, a key part of its “Origins” strategy unveiled during the Las Vegas shows earlier this summer.

The company announced Monday it has sold a royalty right for an iron ore deposit associated with the Onslow Iron project in West Pilbara, Australia, for $150 million.

De Beers discovered the iron ore deposit while exploring for diamonds in the area. It subsequently sold the ground for cash and a royalty right.

Taurus Funds Management will acquire De Beers Exploration Australia, the subsidiary that owns the royalty, for $125 million upfront and up to $25 million of deferred consideration.

“As part of our Origins strategy, we committed to streamlining the De Beers business. We have already seen significant progress in reducing our overhead costs by reshaping our workforce in support of the new strategy, and the sale of this royalty right continues the process of business streamlining as we exit this non-core asset at the right time and for value,” De Beers Group CEO Al Cook said.

“With a simpler and more efficient corporate structure, we will sharpen our focus on our core business of producing the world’s most beautiful natural diamonds and bringing them to market through the most value-adding channels.”

The sale is expected to close at the end of 2024, pending customary closing conditions.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

Supplier Spotlight Sponsored by GIA

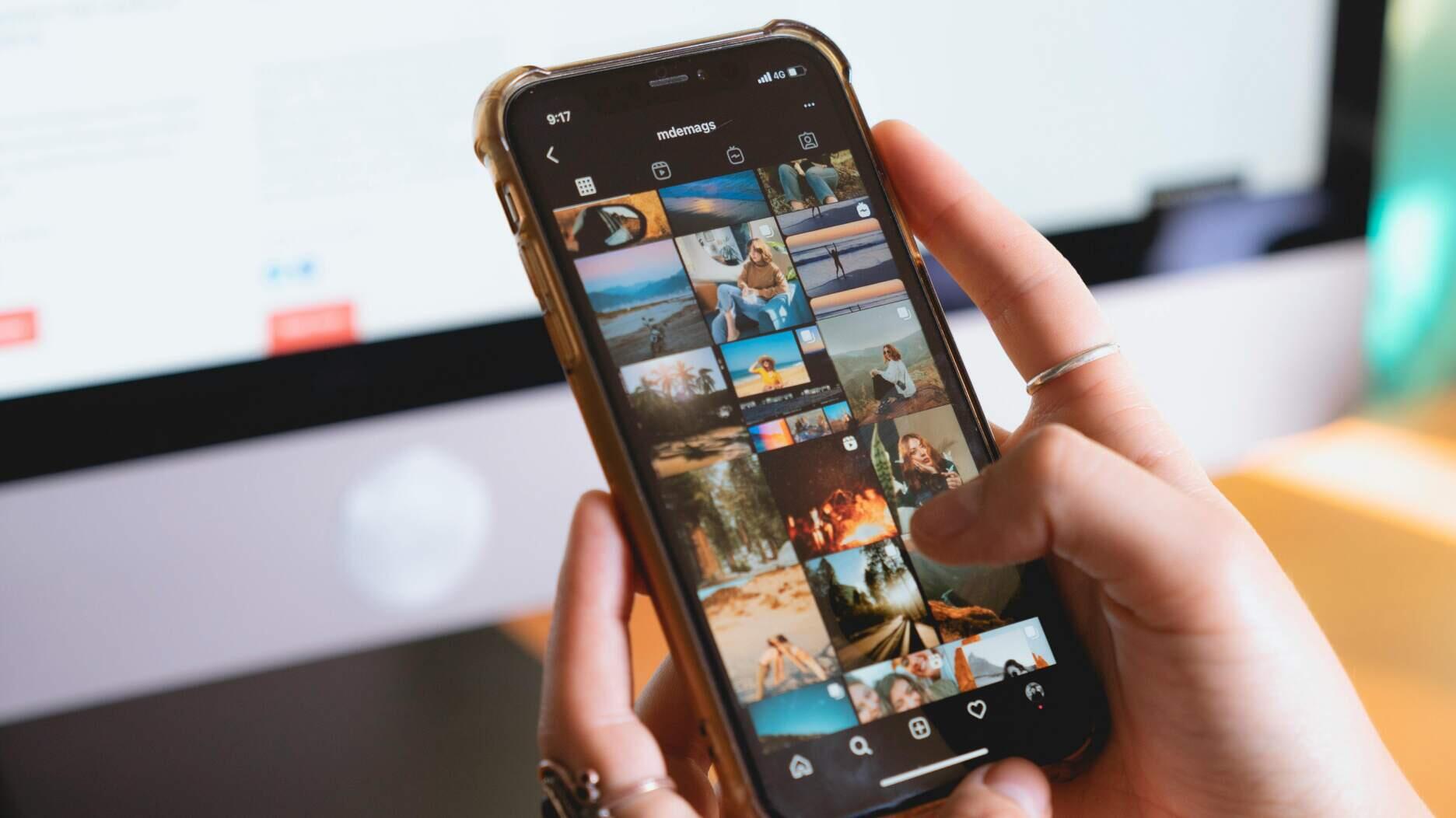

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.

Ingraham said she’ll use the scholarship funds to attend the Women’s Leadership Program at the Yale School of Management.

Moijey Fine Jewelry & Diamonds held a three-week “Mine to Finger 3D Jewelry Program.”