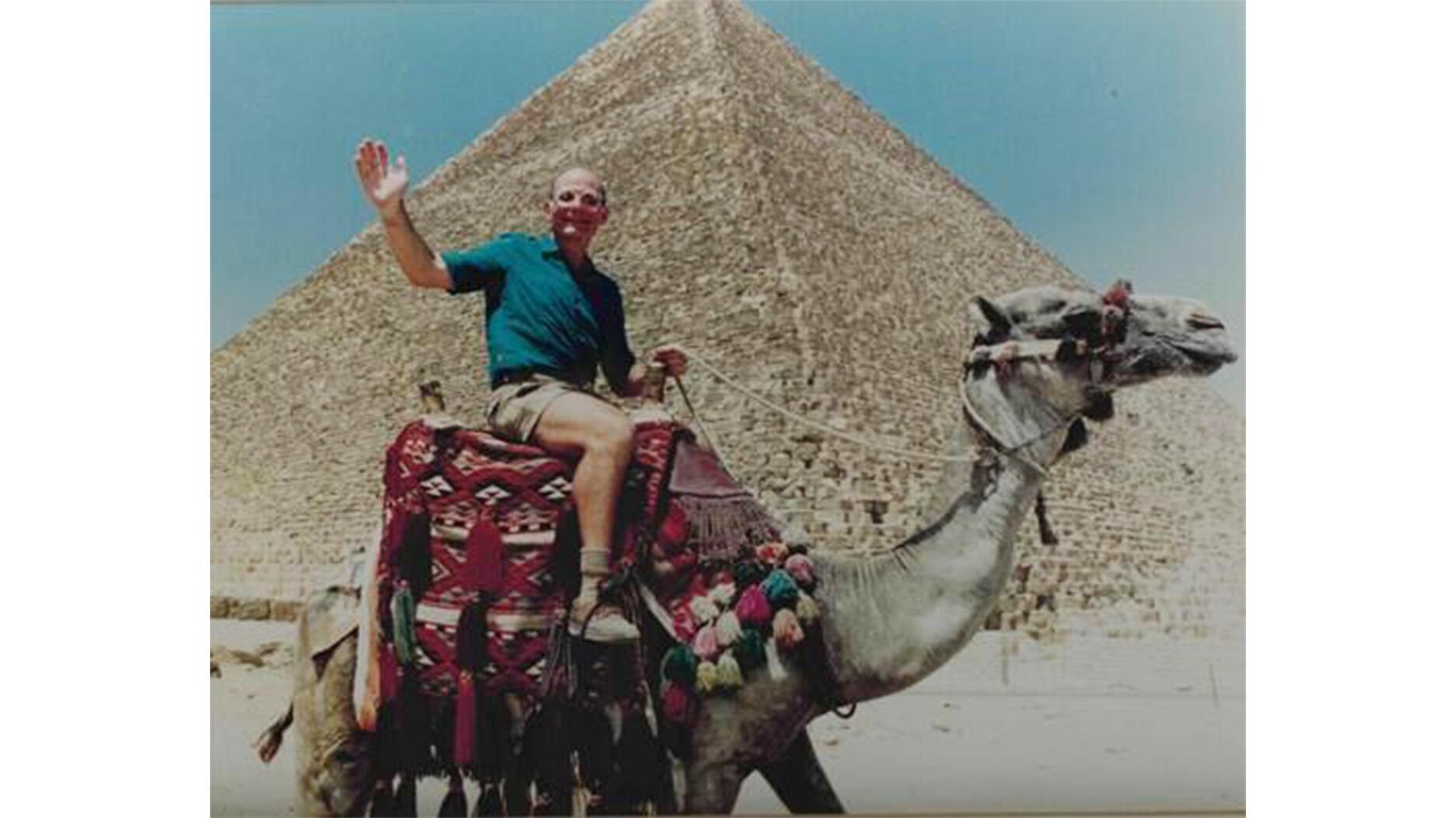

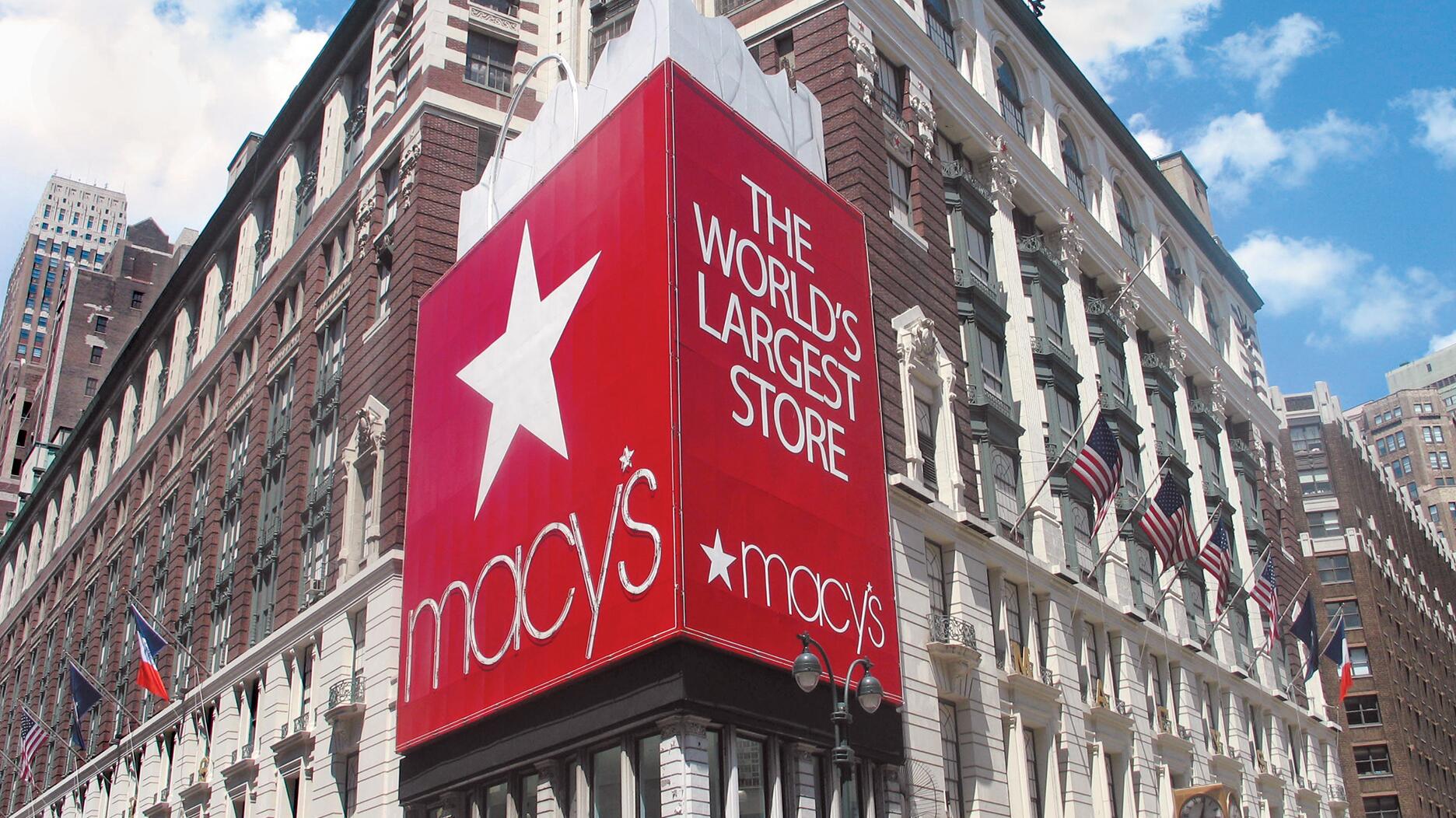

Macy’s Ends Buyout Talks

The retailer will not be making a deal with Arkhouse Management and Brigade Capital Management, opting to focus on its turnaround plan.

In March, real estate investment firm Arkhouse Management and asset management firm Brigade Capital Management offered the department store chain a buyout deal worth $6.6 billion.

It was their second offer after the retailer declined their initial offer of $5.8 billion in December 2023.

Macy’s had been considering the revised offer, opening its books to the firms in April.

However, its board of directors unanimously have decided to end discussions with Arkhouse and Brigade.

“At this time, after careful review, we have concluded that Arkhouse and Brigade’s proposal lacks certainty of financing and does not deliver compelling value, notwithstanding the significant time, resources, and information shared during this process,” said Paul Varga, lead independent director of Macy’s.

Macy’s said it had been working “in good faith” with Arkhouse and Brigade for more than seven months now, with the understanding that there was a willingness to possibly increase the purchase price to an amount Macy’s board might accept.

Following “hundreds of hours” of due diligence, the involved companies agreed that Arkhouse and Brigade would deliver a fully financed and actionable proposal to Macy’s by June 25.

The offer was to include the best purchase price per share and fully negotiated commitment papers for all the debt and equity needed to finance the deal.

On June 26, Arkhouse and Brigade instead sent Macy’s a “check in” letter, said the retailer, with an increased bid of $24.80 per share.

Though slightly higher than the second offer of $24 per share, it was within a range that Macy’s board already had said was “not compelling.”

In addition, the financing papers submitted to Macy’s were “insufficient,” leading the board to believe that a viable offer cannot be reached within a reasonable period of time.

Macy’s said its management team instead will focus on increasing shareholder value through its latest turnaround plan, called “A Bold New Chapter.”

Announced in February, the plan includes closing 150 stores over the next three years as it grapples with declining sales.

The three pillars of the strategy are: strengthening the Macy’s brand, accelerating luxury growth, and simplifying and modernizing end-to-end operations.

Macy’s Chairman and CEO Tony Spring said, “Our team continues to be singularly focused on creating value for our shareholders. While it remains early days, we are pleased that our initiatives have gained traction, reinforcing our belief that the company can return to sustainable, profitable growth, accelerate free cash flow generation, and unlock shareholder value.”

The board is open to exploring all paths to increased shareholder value, added Varga, and believes the new strategy is the best opportunity for doing so.

Macy’s said it will share additional details about how the strategy has been working so far as part of its second-quarter earnings, which it will report next month.

The Latest

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

Supplier Spotlight Sponsored by GIA.

The giant gem came from Karowe, the same mine that yielded the 1,109-carat Lesedi La Rona and the 1,758-carat Sewelô diamond.

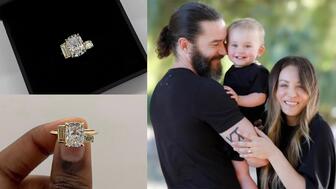

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

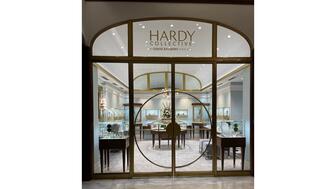

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

Supplier Spotlight Sponsored by GIA

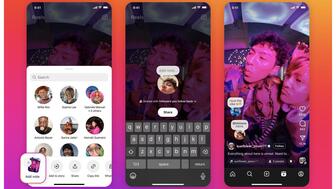

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

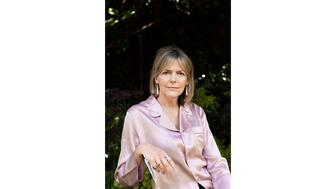

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

The gemstone company is moving to the Ross Metal Exchange in New York City’s Diamond District.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.

Ingraham said she’ll use the scholarship funds to attend the Women’s Leadership Program at the Yale School of Management.

Moijey Fine Jewelry & Diamonds held a three-week “Mine to Finger 3D Jewelry Program.”