Q&A: Watches of Switzerland CEO Brian Duffy Talks Jewelry Strategy

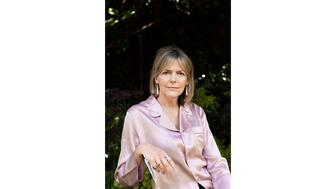

Duffy spoke candidly about the company’s plans to watch and learn, his love for the U.S. market, and what he learned from his mom.

Last month, the company acquired the U.S. arm of Italian jewelry brand Roberto Coin, officially known as Roberto Coin Inc., for $130 million.

The acquisition gives Watches of Switzerland exclusive distribution rights for Roberto Coin jewelry in the United States, Canada, the Caribbean, and Central America.

It’s the latest in a series of recent acquisitions by the retailer, including three Betteridge stores, aimed at bolstering its jewelry offerings.

During Las Vegas Market Week, Associate Editor Lenore Fedow sat down with Watches of Switzerland CEO Brian Duffy at the retailer’s boutique in the Wynn hotel to discuss its jewelry strategy.

This interview has been edited for length and clarity.

Lenore Fedow: National Jeweler recently covered the news about your acquisition of Roberto Coin’s U.S. business. Why did you all choose that brand in particular?

Brian Duffy: Because we love it. I think it’s a great brand driven by just amazing creativity in the product.

That’s not an observation, we were experiencing it. Roberto Coin had developed into being a really important partner for us.

So, we loved the brand, we loved the products, and then, progressively, we got to know the team under Peter [Webster].

(Webster has run Roberto Coin’s U.S. business for decades and will stay on as president of Roberto Coin Inc. post-acquisition.)

Eventually, when we started discussions, we met up with Roberto [Coin] who’s the most charismatic, creative [person] and a great personality, and the rest of his family.

There was a lot to discuss, obviously, because the business was previously part of the group overall. And here they were selling such a big market to a big corporation.

We like to think that we are still very much driven by personalities and engagement. We’re not about processes.

Anyway, that took time to get everybody comfortable with how everything would work, but it was all a good time.

For us, it’s been a great brand. It’s a big brand here [in the U.S.]

There are opportunities for us. First of all, [we want] to change nothing of what the business is today because it’s so well-run. They’ve got great partners around the country. I know all the department stores, and we know many of the independents as well.

So, the whole thing is about reassuring the existing distribution that we’re here to help grow that business.

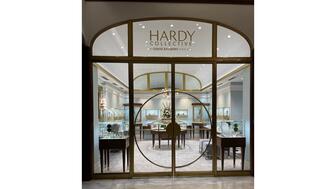

And in addition, we think there are opportunities to elevate the presentation with monobrand [stores], whether it’s us or with our partners.

We love this market, by the way. There’s so much to learn in the U.S. market in particular, the best market in the world.

LF: What makes you say the U.S. market is the best market in the world?

BD: Factually, the size of the market. It’s the biggest diamond market in the world.

[The U.S.] has great style and great brands. How women accessorize here with jewelry is really interesting to me. It’s very thoughtful.

So, we’ve learned a lot, and it’s a tough market. You’ve got such big, successful players here, like Cartier.

LF: Right. There’s a lot of competition.

BD: Within that top market, Roberto Coin has been so successful.

LF: Yes, Roberto Coin is a huge name here, which leads me to my next question. What are your plans for that brand in the U.S. in particular?

BD: We don’t actually come in with a blueprint. You hear all this stuff about 100-day plans. It’s not the way we do things.

The next day, the next 100 days, we’ll be listening and learning. I always quote my mum who said, “Nobody ever learned anything while they were talking.” It’s good advice.

Peter, Roberto, and the team spent a lot of time here [in the U.S.] developing. So, we’re learning from all of that.

There are things we know that we can bring, like store design. We will be investing more in marketing and the digital world.

The focus would be online with the partners, but we can offer [the brand] more in the way of digital support and areas of social media and public relations. I think we have good complementary skills there.

But the first thing is to support the momentum that the business has today with everybody that’s there. There are no plans to synergize or change or anything of that nature whatsoever.

[We want to] learn what we can and see where we can bring complementary skills and opportunities.

We’re ambitious, we’re big, so we’ve got resources. It’s got to be up to Peter and his team to take advantage of what we can bring, rather than us coming along and saying, “Here’s what we should be doing.”

“We want to be bigger in jewelry.”

LF: They’re successful here as it is. They have beautiful things and a very talented group.

BD: Yeah, and I love the trends.

Clearly, there’s a very distinct trend that’s been going on now for many, many years toward brands. And that’s great for Roberto Coin.

The trend towards daywear accessorizing, I think, is really clear. It’s not all sparkly evening wear and diamonds. So, I think that’s great.

It’s so prolific on product development and just so good.

LF: Speaking of brands, there was also some news recently about Watches of Switzerland bringing David Yurman to the U.K. How did that partnership come about?

BD: Again, we saw what an amazing success it is here in the U.S., very much an American success story.

It just does fabulous product that responds, again, to the best market challenges in the world, … most discerning consumers in the world when it comes to jewelry.

We saw it, loved it, and were like, “My God, it’s not in the U.K.?”

We want to be bigger in jewelry. We’ve decided that the percentage of jewelry within our business went down because we were so successful in watches, not that we didn’t love our jewelry brands.

We have great jewelry retail groups, like in the U.K. [we have] Mappin & Webb and Goldsmiths, and now here, Mayors and Betteridge.

We’ve learned a lot from that as well, about high-end clientele and high-end products.

We already had a number of initiatives underway to expand our presence in branded jewelry.

We opened a store in the U.K. [in Manchester] that’s only branded jewelry, not jewelry and watches. And we brought other brands on board with that, like Pomellato and Repossi.

David Yurman will be an important part of that in Manchester. We’re, first of all, launching David Yurman in London.

And again, just wonderful product and great potential.

So, we like to think we’ll learn from others and definitely learn from the U.S. market.

“We like big [stores]. We give the opportunity for brands to really express themselves.”

LF: When you talk about expanding your presence in the jewelry market, how are you going to do that going forward? Do you think there will be more acquisitions? What works for you all?

BD: There will be a number of fronts to it as we’ve developed.

We love investing in stores and it’s what we’re all about, investing for high-quality growth.

We know stores should be big, first of all, foremost. And I think it’s one of the feelings of, if you like the more traditional retail, it’s just physically, the space is small, so therefore people can’t browse.

LF: Smaller stores can be a little more intimidating.

BD: We like big. We give the opportunity for brands to really express themselves.

In any of our stores, when you go, you wouldn’t think you’re not seeing the best of whatever brand we have. We don’t compromise that.

When we came to Mayors, we had proof they were underdeveloped in watches.

As we were increasing space, we gave more space to watches, probably slightly overdid it.

And we recognize now just the great value of jewelry. We are increasing the space that we’re allocating towards jewelry.

We do really good marketing behind jewelry. We have great events and teams.

There’s the VIP element here of accessing special product for clients and even bespoke product. I think it’s a great opportunity.

But you then have got to have the right kind of people and you’ve got to give them the right kind of support opportunities. And I think with scale that we’re able to do that. A big thing is the people fundamentally.

LF: Is there anything else of interest you all have going on that I didn’t ask you about?

BD: No, this is the big deal for us. It’s a huge move in our strategy of getting much more represented in jewelry.

We feel great about it. As for the feedback, we’re meeting a lot of the trade here [at the Las Vegas shows] and, of course, people are going to have some questions.

We just have to prove, as quickly as we can, that everything that’s there is going to remain exactly as it is.

The only things we will bring, I think, will be to everybody’s advantage, like marketing, digital, and so on. That’s our preoccupation right now, to get that right.

We have other things that are going on around the world. We have a very clear strategy for growth for our business.

Our business in America now is the best part of $900 million, and we’ve only been here just over five years. I never predicted that. And half of it’s been what we acquired and the other half has been what we’ve grown.

We love America and we got our timing right, but we still made some big, brave statements, in acquisitions or the stores we opened in New York.

So, we’re going to keep doing what we’re doing as long as it keeps working as well as it is.

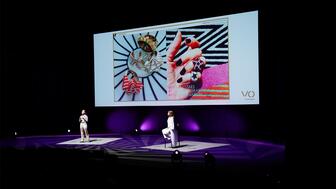

What have you taken away from Couture? What’s impressed you from what you’ve seen?

LF: Yeah, it’s been a little bit of a whirlwind. I’m seeing a lot of color, which I think is fun. I’m seeing a move to more bright and airy pieces.

I’m also seeing a lot of convertible pieces, like a necklace that will turn into a bracelet or big earrings that I can take the jacket off and it’s a stud.

BD: Well, honestly, American women drive a lot of global trends, whether it’s in fashion, which I was in before, now, jewelry and accessories. There’s this wonderful blend between practicality and style.

LF: It’s a great show to people watch. I always like seeing what jewelry people are wearing. The people who know jewelry best, what do they have on?

BD: There’s a lot of choice, mix and match, but the trend is towards daywear, more casual dressing but still very stylish. You want to accessorize it still, so that’s a great trend.

There’s also the trend toward self-purchasing and collection building. Those are all great trends for Roberto Coin.

The Latest

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

Supplier Spotlight Sponsored by GIA.

The giant gem came from Karowe, the same mine that yielded the 1,109-carat Lesedi La Rona and the 1,758-carat Sewelô diamond.

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

Supplier Spotlight Sponsored by GIA

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

The gemstone company is moving to the Ross Metal Exchange in New York City’s Diamond District.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.

Ingraham said she’ll use the scholarship funds to attend the Women’s Leadership Program at the Yale School of Management.

Moijey Fine Jewelry & Diamonds held a three-week “Mine to Finger 3D Jewelry Program.”