Lucapa Sells Stake in Mothae Mine

The Australian miner has signed over its 70 percent share in the diamond deposit to Lesotho company Lephema Executive Transport.

Lephema has provided long-term mining services for the deposit, which is located in Lesotho, a small, landlocked kingdom encircled by South Africa.

It will give Lucapa a nominal fee of 10,000 Australian dollars ($6,660) for the share. Lephema will also assume all liabilities and guarantee obligations relating to the Mothae mine, the mining company said.

Site owner Mothae Diamonds will pay Lucapa AU$1 million ($665,900) in outstanding technical services payments.

Following the completion of the agreement, which is expected to finalize Sept. 30, Lucapa will continue to provide technical services to Mothae for a minimum of three months.

Lucapa said the Australian Securities Exchange confirmed shareholder approval is not required for the deal.

Conditions of the sale include an approval from the Lesotho Ministry, as well as Lephema’s continuation of the off-take agreement Lucapa signed with Graff subsidiary Safdico, under which the manufacturer purchases 100 percent of the rough from Mothae.

Mothae started mining and processing operations in January 2019.

It has produced several high-value diamonds, including a 215-carat rough in 2021 and a 204-carat rough stone in 2022, as well as various fancy colored diamonds.

Lucapa announced in May that it was looking to offload its stake in the mine, which it owns in part with the Lesotho government, later calling it a non-core asset.

Lucapa Managing Director and CEO Nick Selby, who stepped into the role last summer, said the divestment is a “key step” in the company’s plan to streamline its portfolio and focus on developing its assets in Angola and Australia.

“This agreement is the result of a period of offer and negotiation involving Lucapa and several interested parties,” Selby said. “Lucapa wanted to, as far as possible, see this mine continue to operate and [Lephema is] best placed to achieve this.”

Lucapa owns a 40 percent stake in the Lulo alluvial diamond mine in Angola, with the remaining share split between state-owned Endiama and Rosas & Petalas, a private company.

The miner was conducting feasibility studies at the Merlin Diamond Project in Australia’s Northern Territory, though the large-scale initiative was put on hold in November 2023.

It’s also exploring for diamonds in Botswana and Western Australia.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

Supplier Spotlight Sponsored by GIA

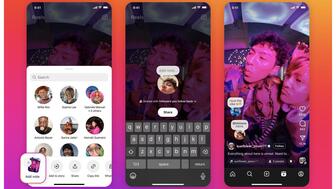

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.

Ingraham said she’ll use the scholarship funds to attend the Women’s Leadership Program at the Yale School of Management.

Moijey Fine Jewelry & Diamonds held a three-week “Mine to Finger 3D Jewelry Program.”