JA, Industry Leaders Take Russian Diamond Import Concerns to D.C.

The group met with lawmakers to raise awareness about the financial, operational, and supply chain harms posed by an EU proposal.

New York—Jewelers of America hosted a trip to Washington, D.C., last week, leading a group of industry stakeholders to discuss the implementation plans for U.S. import restrictions on Russian diamonds with lawmakers.

Their concerns centered on an EU proposal that would force all Group of Seven nations-bound rough diamonds of 0.5 carats and above through a single import channel in Belgium, starting Sept. 1.

JA President & CEO David Bonaparte represented the organization and led the group consisting of Jon Bridge, chair/counsel emeritus of Ben Bridge Jeweler; Dave Meleski, president and CEO of Richline Group; Matthew Swibel, vice president of sustainability and social impact at Signet Jewelers; and Ronnie VanderLinden, immediate past president of the Diamond Manufacturers & Importers Association of America and president of the International Diamond Manufacturers Association.

The group met with a dozen Democratic and Republican lawmakers in both the U.S. House of Representatives and the Senate who serve on committees that oversee trade-related issues.

Their message was this—the proposed adoption of an exclusive physical verification and certification system in Belgium for all rough diamonds would cause “maximum damage to the global diamond and jewelry supply chain, while having minimal effect on Russia’s diamond revenues.”

On March 1, U.S. Customs and Border Protection (CBP) issued guidance on importing polished diamonds weighing 1 carat or more into the U.S. just as the G7’s new restrictions on diamonds mined but not cut in Russia took effect.

Expanded regulations are set to take effect Sept. 1, when the size threshold will drop to 0.5 carats and the import rules will extend to finished jewelry, lab-grown diamonds, and watches.

Until then, the G7 technical committee is working on a traceability plan to further monitor and restrict the circulation of Russian rough diamonds, which is where Belgium comes into play.

According to the Sanctions resource page launched in March on the Jewelers Vigilance Committee website, one method of tracking would require rough diamonds to enter G7 countries via specific “nodes”—the EU has proposed Antwerp, Belgium be the node—for uploading onto a blockchain to ensure source verification.

The FAQ adds, “We don’t yet fully know what this looks like or how expeditiously goods will move from source countries to the node for registration to cutting factories.”

JA and the other advocates who met with lawmakers last week stated that the financial, operational and supply chain harms posed by the EU’s proposal is “too great for the U.S. government to accept.”

The group’s discussions at the Capitol highlighted supply chain disruptions that stem from the proposed import requirements and the resulting increased cost to American jewelry consumers.

“JA has been working tirelessly behind the scenes and this visit to Washington, D.C., was a critical step to ensure we minimize unnecessary disruptions to the U.S. diamond industry,” Bonaparte said.

“We are very concerned about the additional requirements that could take effect on Sept. 1, including adopting a European Union proposal that would force all G7/U.S.-bound diamonds of a half a carat and above through a single import channel in Belgium.”

The group also lobbied for a “grandfathering” clause that would apply to all diamonds and diamond jewelry imported into the U.S. prior to March 1, 2024.

JA said this step is necessary for protecting the value of the trillions of dollars of diamonds and diamond jewelry held by the U.S. consumers, as well as the inventories of the U.S. diamond jewelry industry.

Also in D.C., the group shared the benefits of maintaining attestation of rough and loose diamonds imported into the U.S. and the current certification systems in place at producer-country level.

The advocates stressed the value of issuing additional guidance that would make it clearer, to both the industry and CBP officials, that the current 1-carat import restrictions apply only to individual, loose diamonds and not the total weight of all diamonds in finished jewelry.

“JA continues to staunchly support efforts that will keep diamonds of Russian origin out of the supply chain, including the more stringent U.S. Customs and Border Patrol requirements that went into effect on March 1,” JA said.

“Jewelers of America calls on all JA members to support this effort by using JA’s Legislative Action Center to tell Congress that the proposed restrictions slated for Sept. 1 go too far and will hurt jewelry businesses.”

On Sept. 18, JA will host its annual fly-in, which offers JA members an opportunity to meet with their congressional representatives to discuss Russia and other key issues.

The day prior to the fly-in, Sept. 17, JA will host one of its Multifaceted Learning Workshops at The Army & Navy Club.

To learn more about JA’s advocacy efforts, visit the organization’s website.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The giant gem came from Karowe, the same mine that yielded the 1,109-carat Lesedi La Rona and the 1,758-carat Sewelô diamond.

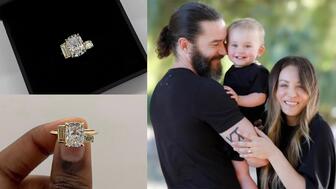

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

Supplier Spotlight Sponsored by GIA

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

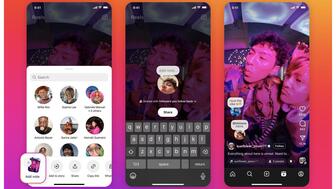

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

The gemstone company is moving to the Ross Metal Exchange in New York City’s Diamond District.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.