Consumer Confidence on the Rise in June

Consumer spending may shift to services as “revenge spending” on post-pandemic travel slows, said the Conference Board.

The Conference Board’s consumer confidence index rose to 109.7 in June from a slightly upwardly revised 102.5 in May.

“Consumer confidence improved in June to its highest level since January 2022, reflecting improved current conditions and a pop in expectations,” said Dana Peterson, chief economist at The Conference Board.

“Greater confidence was most evident among consumers under age 35, and consumers earning incomes over $35,000. Nonetheless, the expectations gauge continued to signal consumers anticipating a recession at some point over the next six to 12 months.”

The Present Situation Index, which measures consumers’ current view of business and labor market conditions, rose to 155.3 from 148.9 in May.

Consumers’ assessment of current business conditions was more positive in June.

The percentage of respondents who said current business conditions are “good” was up to 24 percent from 20 percent in May, while those who said conditions were “bad” decreased, down to 16 percent from 17 percent.

Consumers also had a more positive view of the labor market.

The percentage of respondents who felt jobs were plentiful was up to 47 percent in June from 43 percent in May, while 12 percent said jobs were “hard to get” compared with 13 percent the previous month.

The Expectations Index, which measures consumers’ outlook for income, business, and labor market conditions in the near future, rose to 79.3 from 71.5 in May.

The Expectations Index has remained below 80—the level associated with a recession within the next year—every month since February 2022, with the exception of a brief uptick in December 2022, according to the Conference Board.

Still, June’s reading fell just below that threshold, the organization pointed out, and increased significantly when compared with May.

Consumers were slightly more optimistic about the short-term business conditions outlook, with 14 percent expecting business conditions to improve, up from 13 percent in May.

Fewer respondents expect business conditions to worsen—18 percent compared with 21 percent.

Consumers’ view of the short-term labor market also was upbeat.

More respondents expect more jobs to be available, up to 16 from 14 percent.

Meanwhile, 16 percent expect there to be fewer jobs, down from 21 percent in May.

“Assessments of the present situation rose in June on sunnier views of both business and employment conditions. Indeed, the spread between consumers saying jobs are ‘plentiful’ versus ‘not so plentiful’ widened, indicating upbeat feelings about a labor market that continues to outperform,” said Peterson.

Improving expectations about the next six months also signal greater confidence in future business conditions and job availability, she said.

Consumers’ short-term income expectations, however, were more pessimistic.

Fewer respondents expect to see their incomes increase, down to 17 percent from 19 percent in May, while 12 percent expect their incomes to decrease, up from 11 percent.

The Conference Board recently added a new set of questions to its monthly survey, asking consumers how they felt about their family finances.

In June, respondents’ answers reflected “largely healthy” family finances, said the Conference Board.

The number of respondents who described their current family financial situation as “good” remained essentially flat in June, holding around 29 percent.

Fewer respondents described their family financial situation as “bad,” down to 18 percent from 20 percent.

Looking ahead, consumers’ outlook on their family finances in six months’ time improved.

Thirty percent of respondents said they expect their family finances to be “better,” up from 29 percent in May, while 14 percent expect them to be “worse,” down from 15 percent.

“This positive outlook might reflect consumers’ expectation that labor market conditions will remain favorable and that there may be further declines in inflation ahead,” said the Conference Board.

The Conference Board also added a measure to gauge respondents’ thoughts on a recession.

In June, 69 percent of consumers said a recession is “somewhat” or “very likely,” down from 73 percent in May.

Recession fears had been rising steadily since August 2022, said the Conference Board, but “eased considerably” in June.

Notably, plans to make big purchases, both automobiles and home, have slowed down after seeing an uptick earlier in the year.

This may be in response to the rising costs of financing those items as the Federal Reserve continues to raise interest rates, said the Conference Board.

Vacation plans within the next six months are also flagging, led by a decline in plans for domestic travel.

“This is an important indicator of desire to spend on services ahead, which may be a signal that post-pandemic ‘revenge spending’ on travel may have peaked and is likely to slow over the rest of this year,” said Peterson.

The consumer confidence stats for July will be available July 25.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The giant gem came from Karowe, the same mine that yielded the 1,109-carat Lesedi La Rona and the 1,758-carat Sewelô diamond.

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

Supplier Spotlight Sponsored by GIA

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

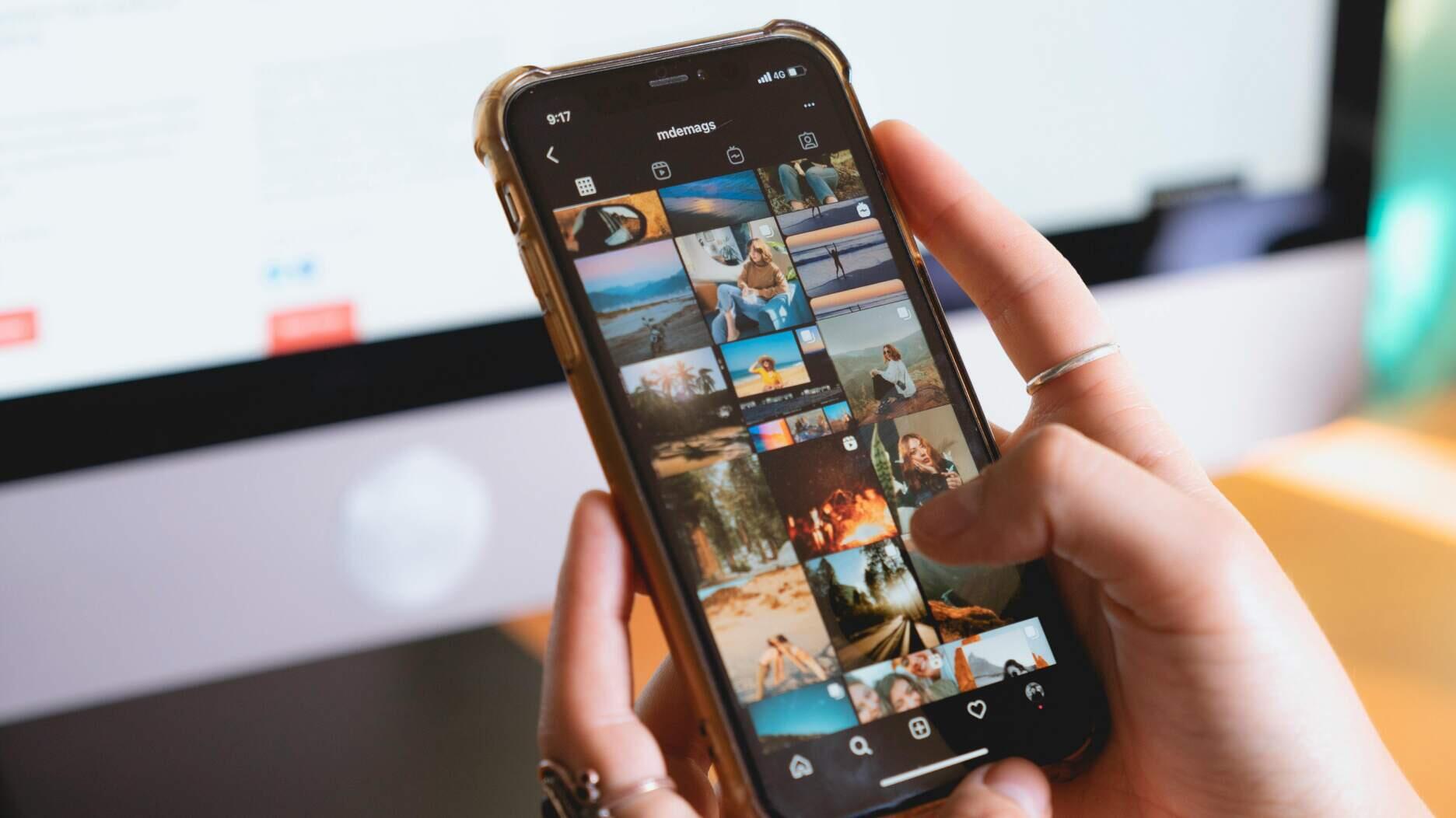

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

The gemstone company is moving to the Ross Metal Exchange in New York City’s Diamond District.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.