U.S. Sanctions Gold Cos. Allegedly Tied to Russian Mercenary Group

OFAC sanctioned four companies it claims are helping fund the Wagner Group, the organization that just attempted a coup in Russia.

The Wagner Group is a government-backed network of mercenaries (fighters for hire) that has been heavily involved in Russia’s invasion of Ukraine, including the capture of the city of Bakhmut in eastern Ukraine.

In recent months, though, the relationship between Prigozhin and the Russian government has soured, with Prigozhin accusing the country’s military leadership of incompetence and claiming they were withholding ammunition from his fighters.

On Saturday, the Wagner Group staged an insurrection that was quickly de-escalated but has raised questions about Russian President Vladimir Putin’s ability to hold onto power.

Prigozhin and the Wagner Group already are under U.S. sanction.

On Tuesday, OFAC announced sanctions against four companies and one individual it claims are involved in illicit gold dealings that fund the Wagner Group.

They are:

— Midas Resources SARLU, a company based in the Central African Republic that is affiliated with Prigozhin and has mining concessions and licenses for sites where precious metals and gemstones are mined;

— Diamville SAU, another CAR-based company controlled by Prigozhin;

— Industrial Resources General Trading, a Dubai, United Arab Emirates-based industrial goods distributor that allegedly has provided financial support to Prigozhin through its business dealings with Diamville; and

— Limited Liability Company DM (also known as OOO DM), a Russia-based firm that allegedly participated in a gold selling scheme.

OFAC also sanctioned one individual, Andrey Nikolayevich Ivanov, a Russian national it says is an executive in the Wagner Group.

“The Wagner Group funds its brutal operations in part by exploiting natural resources in countries like the Central African Republic and Mali,” said Brian E. Nelson, the Treasury Department’s undersecretary for Terrorism and Financial Intelligence.

“The United States will continue to target the Wagner Group’s revenue streams to degrade its expansion and violence in Africa, Ukraine, and anywhere else.”

The U.S. Treasury Department announced the sanctions the same day a group of federal agencies, including the State Department and the Department of Homeland Security, published a lengthy advisory on gold from sub-Saharan Africa that U.S. State Department’s Brad Brooks-Rubin described as “unique.”

Available to read in full online, the alert calls attention to the “increasingly concerning reporting” on illicit actors, like the Wagner Group, exploiting weaknesses in the gold supply chain across sub-Saharan Africa to finance their activities.

Industry participants, “should be prepared for increased U.S. government attention to the relationship between gold and these groups’ revenue streams and should be prepared for the possibility that U.S. sanctions could be used to disrupt these groups’ operations,” the alert states.

It notes the importance of companies doing their due diligence when it comes to sourcing gold and reporting publicly on their efforts whenever possible.

The alert also calls on U.S. individuals and entities that are involved in the gold trade to support responsible investment in both large-scale gold mining operations in Africa as well as its artisanal and small-scale gold mining sector (ASGM), which employs an estimated 10 million to 25 million people.

The advisory includes a list of three non-governmental organizations working to improve Africa’s ASGM sector and the lives of the people who depend on it.

They are: Impact (formerly Partnership Africa Canada), an NGO that specializes in artisanal and small-scale mining in Africa; the Alliance for Responsible Mining, which works to better the lives of artisanal and small-scale miners worldwide through capacity building and improved market access; and the Artisanal Gold Council, which focuses on training, education, and capacity-building programs, as well as guiding sector governance.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The giant gem came from Karowe, the same mine that yielded the 1,109-carat Lesedi La Rona and the 1,758-carat Sewelô diamond.

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

Supplier Spotlight Sponsored by GIA

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

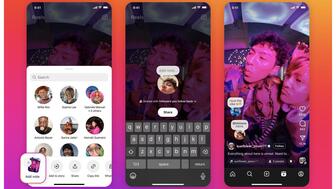

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

The gemstone company is moving to the Ross Metal Exchange in New York City’s Diamond District.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.