Lucara Secures $220M in Financing to Take Mine Underground

The company has received credit-approved commitments from five financial institutions for the expansion of its Karowe Diamond Mine.

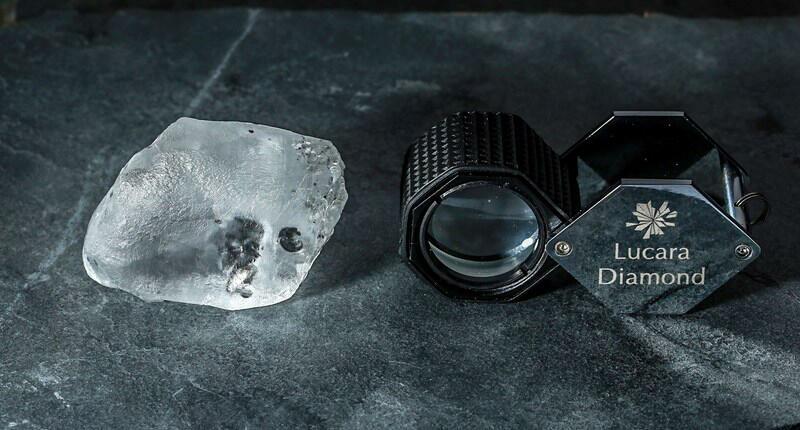

Karowe is responsible for producing some of the most significant diamonds recovered in recent years, including the 1,109-carat “Lesedi La Rona,” which Graff bought for $53 million, and a 1,758-carat diamond that Louis Vuitton is turning into jewelry.

The credit-approved senior debt facilities include two tranches: $170 million to go toward the development of the underground mine and $50 million to support the ongoing operation of the open pit.

The underground expansion has an estimated capital cost of $514 million and is expected to take five years. The balance of development capital for the project is expected to come from cash flow from the mine’s ongoing open-pit operations.

In a statement announcing the financing, Lucara President and CEO Eira Thomas called securing the financing “an important achievement for Lucara and a strong endorsement of our underground expansion plans.”

The five lenders on the $220 million financing facility for Lucara are: ING Bank N.V., Natixis, the London branch of Societe Generale, Africa Finance Corp., and Afreximbank. Thomas described them as having “significant mining and metals track records and experience in Africa.”

Closing on the facilities is subject to completion of definitive documentation and the satisfaction of certain terms and conditions, including Know Your Customer (KYC) checks.

The target closing date for the financing package is mid-2021, with financing expected to be in place by the second half of the year.

Lucara made the financing announcement the day before it released its first-quarter 2021 results.

Revenues totaled $53.1 million, or $579 per carat sold, for the miner in Q1. Net income was $3.4 million.

That is a significant improvement over Q1 2020, when the onset of the pandemic limited sales to $34.1 million and caused Lucara to record a loss of $3.2 million.

First-quarter 2021 results also are up when compared with 2019, when Lucara reported revenues of $48.7 million, or $512 per carat sold. Net income for the latter, however, was higher at $7.4 million.

The company said overall, the diamond market started 2021 in its healthiest position in five years following strong holiday seasons in the United States and China, and careful rough supply management by producers, which has helped to recalibrate polished inventories.

“Lucara has bounced back in the first quarter of the year, demonstrating its resiliency at a time of continued uncertainty in respect to the ongoing COVID-19 pandemic,” Thomas said.

“Our outlook for the diamond market remains strong, and with close to 20 years of future mining now ahead of us at Karowe, Lucara is highly levered to an improving diamond price environment, particularly in respect to large, high-value gem diamonds.”

During the quarter, Lucara announced the recovery of two top white, gem-quality diamonds weighing 341 and 378 carats from the mine’s South Lobe. Both stones were completely intact.

In April, the miner announced it was extending its agreement with HB Antwerp to cut and polish all the larger (10.8 carats and up) diamond recovered from Karowe. The extension takes the agreement through December 2022.

Karowe’s large, high-value diamonds account for 60-70 percent of Lucara’s annual revenues.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

Supplier Spotlight Sponsored by GIA

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.

Ingraham said she’ll use the scholarship funds to attend the Women’s Leadership Program at the Yale School of Management.

Moijey Fine Jewelry & Diamonds held a three-week “Mine to Finger 3D Jewelry Program.”