Q&A: Gemist CEO Madeline Fraser on Jewelry Visualization Technology

Fraser shares why she decided to shift from a direct-to-consumer retailer to a B2B technology company.

Inspired to develop a solution, she launched Gemist, a direct-to-consumer jewelry brand aimed at simplifying the online jewelry buying process.

The company, with early investors like De Beers, became known for its try-before-you-buy approach—letting customers make a custom design online and then receive a free replica of the piece.

Jewelry, with its relationship-heavy selling model and personal, high-ticket items, has long been an industry that seemed reliant on a brick-and-mortar shopping experience, but Fraser was seeing success online.

Many store owners didn’t see the need for an online presence until the COVID pandemic hit, and they realized that, even if they expected stores to re-open, they had to stay afloat in the meantime.

While foot traffic did return eventually, retailers had also learned that shoppers weren’t afraid to make big jewelry purchases online.

The technology, which included features like virtual try-on tools, was getting better at bridging the gap between online and in-store, and retailers were becoming more confident in establishing an omnichannel approach to selling jewelry.

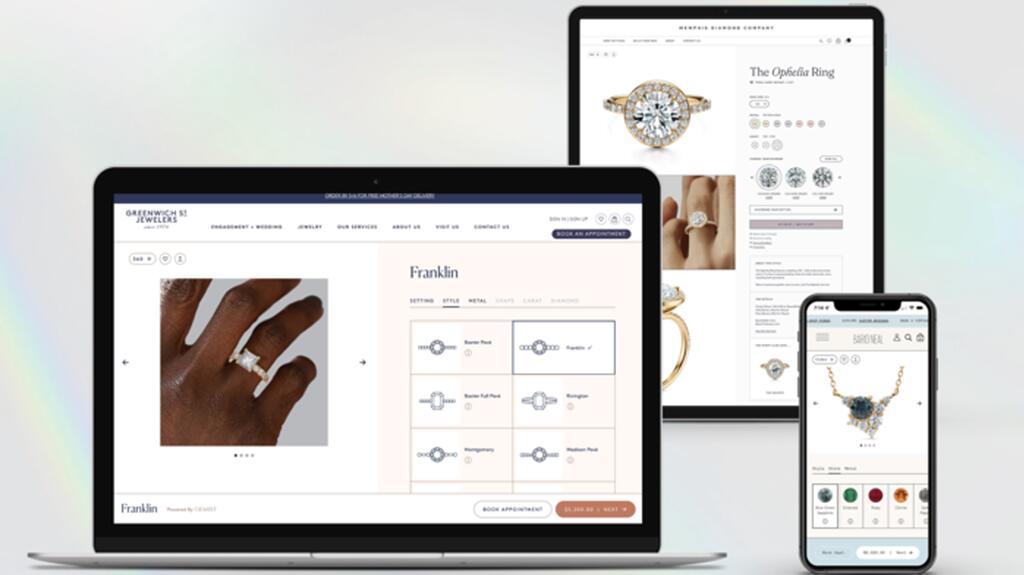

After quietly clocking the opportunity to serve the industry in a new way, Gemist announced in May it had shifted to a B2B model, licensing its jewelry customization technology to the jewelry industry.

It now bills itself as a jewelry visualization platform that specializes in customization and stone marketplace technologies.

I sat down with Fraser at the Couture show in Las Vegas last month, where the company was advertising its new offering with the industry in-person for the first time.

We dove into her decision to shift the business.

Lauren McLemore: Tell me a little about your background in tech.

Madeline Fraser: I'm a three-time company founder. I've been creating and growing tech companies for the last 11 years. I started my first company when I was a junior in college, and I've literally never done anything else. I’ve never looked back.

LM: So, Gemist isn’t your first company, but it is your first jewelry tech business, right?

MF: My last companies were in the furniture and interior design spaces but those are interestingly aligned with jewelry, if you think about it.

They’re also traditional industries and very hard to visualize, right? Like, what does a sofa look like in my space? They both have high average order value ticket items.

So, we cracked a lot of those pain points and solutions for visualization in those industries. I applied what I had learned in those companies to Gemist.

LM: You started Gemist as a DTC brand. What did you learn while selling jewelry that prepared you to shift Gemist into a B2B offering?

MF: As a direct-to-consumer brand, we were doing everything from selling the jewelry to manufacturing the jewelry, learning all the elements of front-end and back-end and everything that brands and retailers have to deal with on a daily basis.

Because of that, we had a ton of consumers using our technology and we were able to learn a lot from them.

Through user testing, we were able to iterate our technology to continue to improve it and make it even better. And we were seeing incredible results.

Compared to industry standards, we were seeing 5x increases in engagement and 3x average order value increases. We were doubling units per transaction sold at checkout, and we were creating a more loyal consumer who was repeating and coming back more often.

At that point was when I started thinking, “We have something really special here—and it’s working.”

As a venture-backed company, we have to grow quickly and innovate. The future of Gemist for me is that, I want to define an industry. I want to change something, and I want to see innovation happen.

To me, being a direct-to-consumer company wasn't innovative enough. It wasn't dynamic enough. And we were also seeing COVID change everything.

The timing was incredible, because it said to the traditional industry of jewelry, “Let’s start thinking about things in a new way. Let's start diversifying sales channels. Let's start thinking about an omnichannel approach to a jewelry business model.”

I was saying, “We’re doing that as DTC company, but what if we could license this to the industry and how would that impact the industry as a whole?”

That felt a lot more important, a lot more dynamic, and a lot bigger, I guess.

I put a stake in the ground. I told our board and our team that we were going to become a SaaS (Software as a Service) company, that we're basically shifting from DTC to B2B.

We're taking our proven technology and white labeling it for the industry.

For the last year and a half, all we've been doing is quietly approaching companies that we are passionate about, that we love, and that we want to work with.

And that's how we've built our client base to date. And so, now we have product market fit, we have proof of concept. It's working, it's growing. And now, we're ready to say, “Okay, we can scale this, let's tell the industry about it.”

LM: You mention that COVID changed everything. What was it about that time that illuminated the need for a platform like Gemist?

MF: Data shows that a small portion of the jewelry industry is online. Before COVID, only 10 percent of the entire $350 billion global industry was online.

Overnight, brick-and-mortar retailers were forced to get online or die.

So, what do they do in that circumstance? They had to figure out how to sell online quickly. That’s really a hard thing to do in this industry because there's no vertical software built for the specific pain points of the jewelry industry.

If you’re buying a jacket or a dress online, it's very different than buying a piece of fine jewelry, right?

So, unless that experience is figured out, and that funnel is optimized, you're going to have high bounce rates, low engagement, and abysmal conversion.

We spoke with people who were building and launching sites, and then they weren't actually converting at all.

They’re thinking, “I put so much time and energy into trying to do that, and I'm not making any more money because of it.”

We’ve tested our technology in a digital-meets-reality approach where you have to tap that fine jewelry customer multiple times to get them to be engaged, to get them to come back more often, and then ultimately, to get them to convert to a sale.

And that usually starts either online or in store. And then it ends either online or in store. And it's how we engage customers along the way to get them connected to the brand and jewelry. That's where the customization experience works and comes into play.

LM: You’ve talked in the past about your experience of trying to design your own engagement ring online and being shocked at how impossible it was for you to do that.

MF: Yeah, it was very clunky technology, not responsive on mobile, desktop, or tablet, or it was crashing a lot. I couldn't visualize what the piece really looked like.

The biggest takeaway for me, too, was sensory overload.

I kept seeing what was basically an Excel spreadsheet on a website with hundreds of thousands of diamonds, for example, when I'm just a normal person. I don't understand what clarity and fluorescence and ratio means.

And so, being a digital consumer and buying everything online, I was unable to purchase a piece of fine jewelry online. And that blew my mind. That was just shocking to me.

I asked friends and family in my life, “What did you guys do?” And I realized it was a pain point for a lot of consumers.

LM: Did you end up having to go in-store to get the ring you wanted?

MF: I ended up having to go to a family jeweler, draw my ring on a piece of paper, give him a cash deposit, and cross my fingers and hope that this ring became a reality.

It was a very frustrating experience and very in-person, very manual, but I created this ring.

This is the ring that I like to say started Gemist. It’s an extension of who I am. It's a ring that represents me. And that is the beauty of jewelry, right? It's the most personal thing in the world.

What I wanted to do was take that experience and make it better. Because what I felt when I finally saw this ring and got it was magic. I wanted to make that whole experience getting there less broken, easier, and simpler.

LM: What year was this?

MF: This was around 2017. I hadn't even thought about Gemist yet, but I was just going through that process.

LM: At that point, would an in-store jeweler have had any visualization tools to help in your design journey?

MF: There were CADs available, but usually it just looks purple or blue. They’re not rendered and don’t look like the final product so it’s hard to visualize.

They can help you kind of understand what the silhouettes is going to look like, but again, you're driving to a location, meeting with somebody in-person, having to express what you actually want with no visualization tools at all, and then someone is making a CAD for you.

It’s a lot of back and forth.

These are the types of renderings (seen in the video below) that we do.

LM: When it comes to that level of visualization and customization, are you focused on working with a certain type of company?

MF: We’re starting primarily with the brands and the designers first because they're the ones who are designing the jewelry and building those product offerings that are incredibly unique and authentic to them.

From there, we're leveraging those branded experiences, and we're applying them to retailer sites.

If a retailer is hybrid, sometimes retailers are designing their own pieces, and they're supporting brands within their stores, like Greenwich St. Jewelers.

They’re one of our partners, and they do it all—they have a retail location, they have a website, they design their own pieces, and they support brands.

So, if they're doing that, we can work both with their own designs, and we can work with the brands that they're supporting on their site and in store.

The goal, ultimately, is to enable these experiences so brands can scale their collections without holding inventory.

We have a no-inventory model, where, as long as we have a CAD file, we can scale any variant of stone type, carat size, metal type, stone shape, etc. without them having to make any product to photograph it and physically put it online.

They can also hold less inventory in store with all variants visually available in our customization experience via an iPad.

Inventory and photoshoots are a lot of money, a lot of time, and a lot of energy. With Gemist, they don't have to do that. They can scale without inventory at all and they're getting a beautiful tech experience that is engaging their customer in a more meaningful way, psychologically connecting them to the design journey and the customer experience.

Gemist either converts customers online or drives traffic in-store.

If a customer comes in-store, that sales rep has all the data of the piece they built and what stone they selected.

We drive customers who are ready to purchase. Usually, we’re seeing only one conversation is needed to close a sale. We're seeing 4x increases in sales cycles across the board.

LM: What’s the response been like since the news came out about Gemist’s shift to B2B?

MF: It's been really positive. I think when people get it, they really get it, and they get excited.

It's really resonating.

I think it takes companies who are thinking about omnichannel, and who have gone through the pain points of that, to really grasp how this can help them, because they have literally gone through the blood, sweat, and tears.

When it comes to our partners, it’s less about quantity and working with everyone. We really want to make sure that we're working with the right partners, because we're very invested in each project.

We like to say that we're an extension of your team, a true tech partner so you can focus on what you do best—jewelry.

We believe their success is our success. Our goal is to make the right impact, learn from the data, and grow together. We want to be a trusted partner for the next 20 years and beyond.

The Latest

Said to be the first to write a jewelry sales manual for the industry, Zell is remembered for his zest for life.

The company outfitted the Polaris Dawn spaceflight crew with watches that will later be auctioned off to benefit St. Jude’s.

A buyer paid more than $100,000 for the gemstone known as “Little Willie,” setting a new auction record for a Scottish freshwater pearl.

Supplier Spotlight Sponsored by GIA.

Anita Gumuchian created the 18-karat yellow gold necklace using 189 carats of colored gemstones she spent the last 40 years collecting.

The giant gem came from Karowe, the same mine that yielded the 1,109-carat Lesedi La Rona and the 1,758-carat Sewelô diamond.

The three-stone ring was designed by Shahla Karimi Jewelry and represents Cuoco, her fiancé Tom Pelphrey, and their child.

Supplier Spotlight Sponsored by GIA

The Manhattan jewelry store has partnered with Xarissa B. of Jewel Boxing on a necklace capsule collection.

Acting as temporary virtual Post-it notes, Notes are designed to help strengthen mutual connections, not reach new audiences.

The jewelry historian discusses the history and cultural significance of jewelry throughout time and across the globe.

From fringe and tassels to pieces that give the illusion they are in motion, jewelry with movement is trending.

The designer and maker found community around her Philadelphia studio and creative inspiration on the sidewalks below it.

The change to accepted payment methods for Google Ads might seem like an irritation but actually is an opportunity, Emmanuel Raheb writes.

The industry consultant’s new book focuses on what she learned as an athlete recovering from a broken back.

The fair will take place on the West Coast for the first time, hosted by Altana Fine Jewelry in Oakland, California.

Hillelson is a second-generation diamantaire and CEO of Owl Financial Group.

Submissions in the categories of Jewelry Design, Media Excellence, and Retail Excellence will be accepted through this Friday, Aug. 23.

Known as “Little Willie,” it’s the largest freshwater pearl found in recent history in Scotland and is notable for its shape and color.

Clements Jewelers in Madisonville cited competition from larger retailers and online sellers as the driving factor.

The gemstone company is moving to the Ross Metal Exchange in New York City’s Diamond District.

Most of the 18th century royal jewelry taken from the Green Vault Museum in Dresden, Germany, in 2019 went back on display this week.

The Pittsburgh jeweler has opened a store in the nearby Nemacolin resort.

With a 40-carat cabochon emerald, this necklace is as powerful and elegant as a cat.

The Erlanger, Kentucky-based company was recognized for its reliability when it comes to repairs and fast turnaround times.

Unable to pay its debts, the ruby and sapphire miner is looking to restructure and become a “competitive and attractive” company.

The trend forecaster’s latest guide has intel on upcoming trends in the jewelry market.